Trial Balance Bridge: Grid

The Trial Balance Grid is the first screen that appears when you access Bridge. Use the Trial Balance Grid to:

- assign and change TRCs

- create and assign TCCs

- change TCC descriptions

- create and assign Property Codes

- change Property Code descriptions

- add accounts to the Trial Balance Grid.

Use the grid much as you would most spreadsheet applications. You can resize columns and rows, insert and delete rows, move columns, sort the grid, and add accounts. You can also choose not to display accounts with zero balances in the Prior Year or Current Year Balance columns.

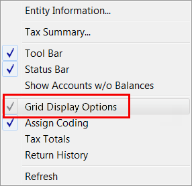

Before working in the Trial Balance Grid, you should set your grid display options. From the View menu, select Grid Display Options:

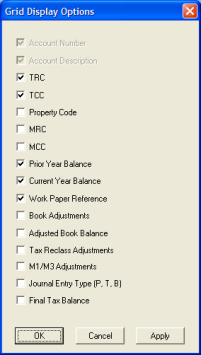

The following dialog appears. Check the items you wish to display on the grid, and click OK:

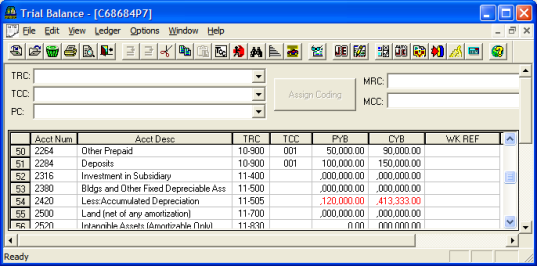

Select the applicable Tax Return Code (TRC) for each general ledger account. The Tax Return Code (TRC) is a Thomson Reuters-defined code that ties the General Ledger account balances to a specific line on the tax return. The Tax Combination Code (TCC) is a user-defined code used with a TRC to customize printed detail schedules. The Property Code (PC) is a mandatory user-defined code used to differentiate data between rental activities (available for 1065, 1120S, and 1120-REIT).

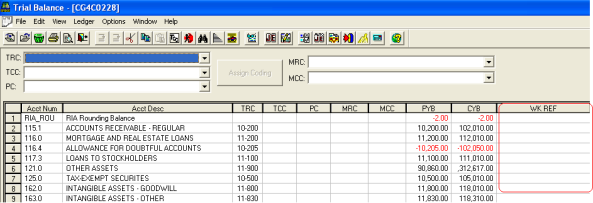

Note that the information from your file appears on the bottom of the Trial Balance Grid. The account number (AcctNum) should be a unique number. The account description (AcctDesc) is a maximum of 50 characters. Prior-Year Balances (PYB) are adjusted book balances which must be in balance and closed. Current-Year Balances (CYB) are balances that can be entered open and unadjusted or closed. To indicate closed, enter CLOSED on the Return Defaults dialog box.

Workpaper Reference Codes tie workpaper notes to specific accounts. To assign codes, select Ledger > Workpaper Notes from the main menu, or enter the reference code in the Wk Ref column next to the account(s).

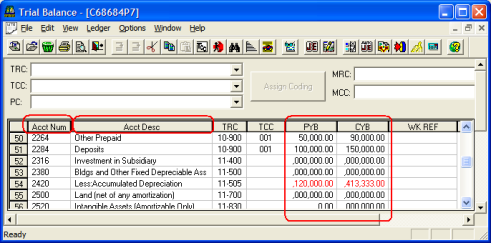

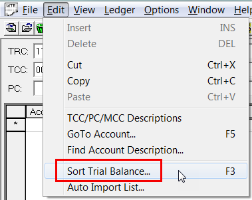

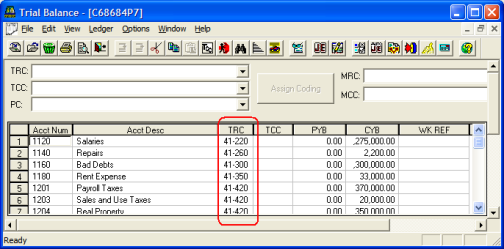

You can customize the Trial Balance Grid by sorting it according to your specifications. You can sort the Trial Balance Bridge by any of the columns circled in red. The Trial Balance Grid is currently sorted by account number.

Select Edit > Sort Trial Balance.

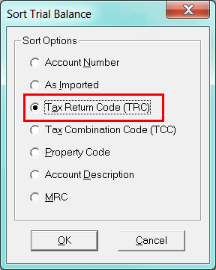

The Sort Trial Balance dialog box appears. To sort the Grid by a different option, such as TRC, select the Tax Return Code (TRC) radio button, and then click OK to sort the Trial Balance Grid by your new option.

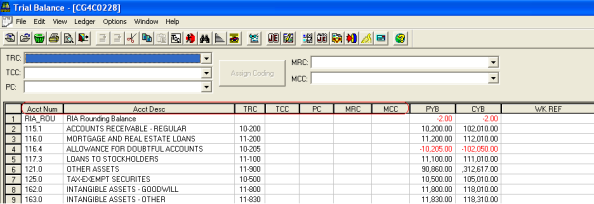

The Trial Balance Grid is now sorted by TRC. Blank TRCs appear at the top of the Grid.

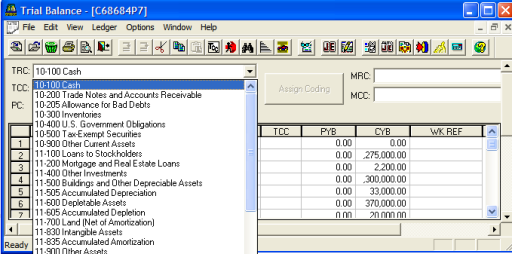

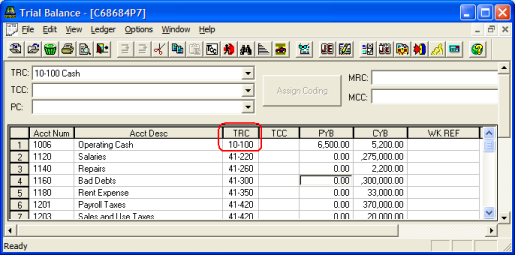

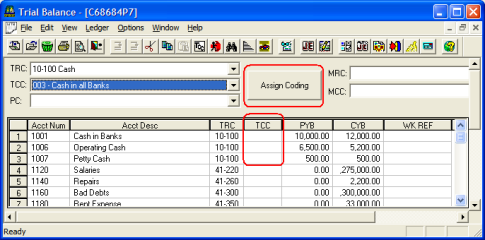

To assign a TRC to Operating Cash, select the appropriate Tax Return Code. Since Operating Cash normally carries to line 1 on the balance sheet of the tax return, in this example, we will select Tax Return Code “10-100 Cash” now.

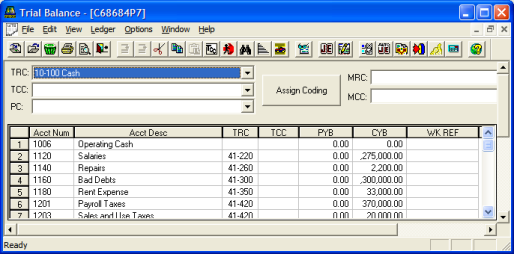

Next, select the cell(s) and/or row(s) to which you want to assign or change the TRC.

- To select multiple cells and/or rows, press the Shift key, hold down the left mouse button, and drag the mouse pointer across the cells and/or rows you want to select.

- To select a range of cells or rows, press the Shift key, and press and click the left mouse button on the first and last cell or row in the range to wihch you want to assign a TRC. All cells or rows between the two selected will be highlighted.

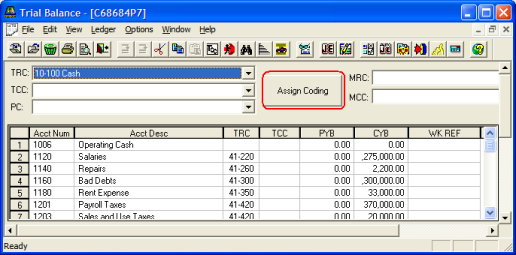

Now click the Assign Coding button for the change to be reflected in the TRC column.

Note that the TRC Code “10-100” appears. Bridge assigns the TRC to the cell(s) and/or row(s) selected. You can also click a specific cell and enter the TRC you need.

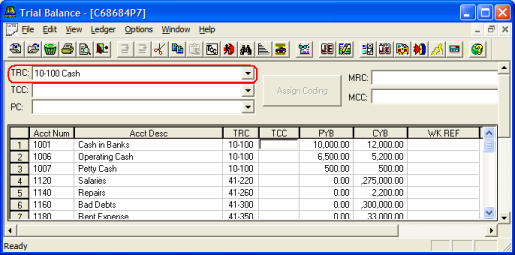

Now we will combine the individual general ledger accounts that relate to cash into one account for tax return purposes. To combine all the cash accounts on the tax return into one account, select Tax Return Code “10-100 Cash.”

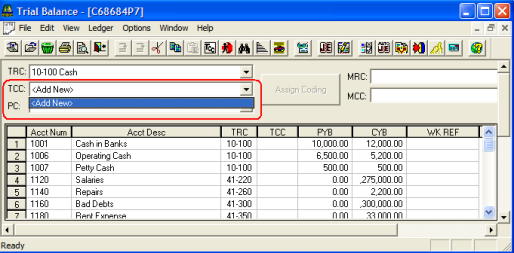

Next, select the Tax Combination Code (TCC) from the drop-down list. If the appropriate code does not exist, create a new one by selecting <Add New>.

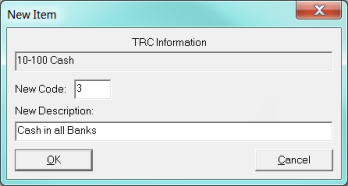

The New Item dialog box appears. Enter the TCC in the New Code field and the description in the New Description field.

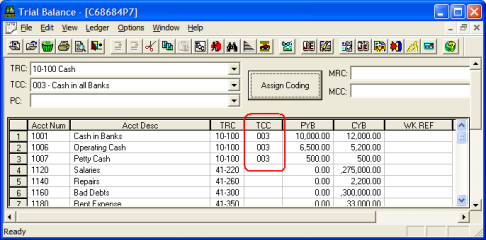

Now the new TCC must be entered for all the cash accounts that you want to tie together to present one cash amount on the tax return. Highlight all the cells to which you want the new TCC assigned, and click Assign Coding. Click the heading TCC, then click Operating Cash, and drag the mouse point to the TCC cell for Cash in Bank. You can also select a group of items by using Shift and Ctrl.

Note that the new TCC “003” now appears next to all the cash accounts. These accounts will now be grouped, and the description Cash in all banks will be printed on the detail statements.

Tutorials/bridge_grid.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.