1120: Multistate Consolidations - State Setup

Required Input - Consolidation

When creating the returns, you must enter the following information on the Consolidation return in the multi-state consolidation (multi-state entry is in bold):

- Company name

- Select states to include in the consolidation

- Parent / Subsidiary / Eliminations return list

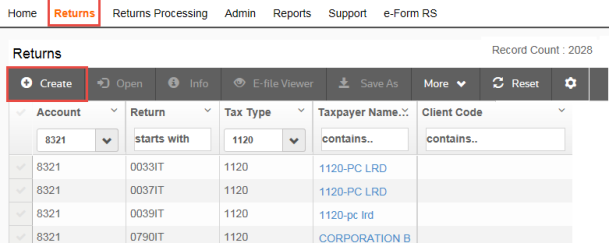

Creating Returns

Create any needed new returns. Select Returns from the top menu, and then select Create. This opens the screen to create new returns.

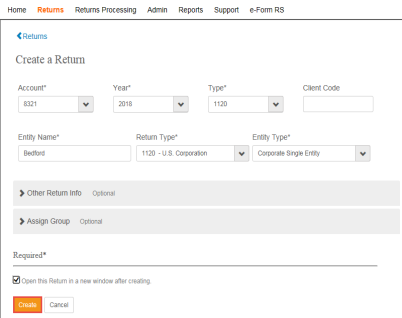

On the Create a Return screen, enter the Account*, Year*, Type*, and Client Code. Then enter the Entity Name*, Return Type*, and Entity Type*. Items marked with an asterisk are required. Select the check box to Open this Return in a new window after creating. Click the Create button.

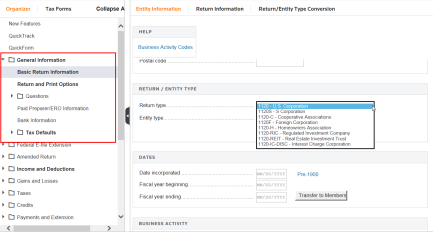

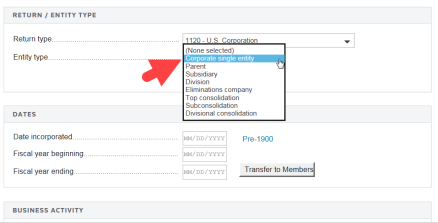

For each return, access the Entity Information tab on the General Information > Basic Return Information screen. It is mandatory that you specify the appropriate return type for all returns in the consolidation.

You must also select the appropriate Return/Entity Type for each return in the consolidation.

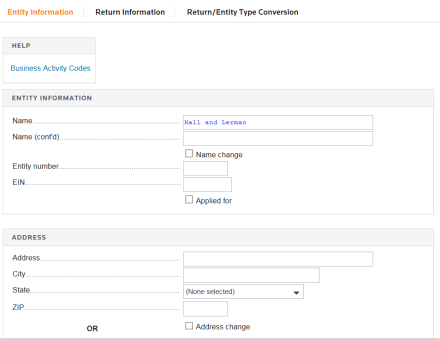

Use the Entity Information Organizer screen to enter the name, address, and federal EIN information for each of the returns in the consolidation. All company information entered on this screen carries to the consolidated return, Form 851, and Form 1122. The company name and ID number carries to all detail schedules. All company information entered on this screen in the parent return will print on the consolidated return.

Tutorials/1120_multistate_cons_state_setup.htm/TY2019

Last Modified: 03/19/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.