1120: Multistate Consolidations - Parent/Subsidiaries Common State Entries

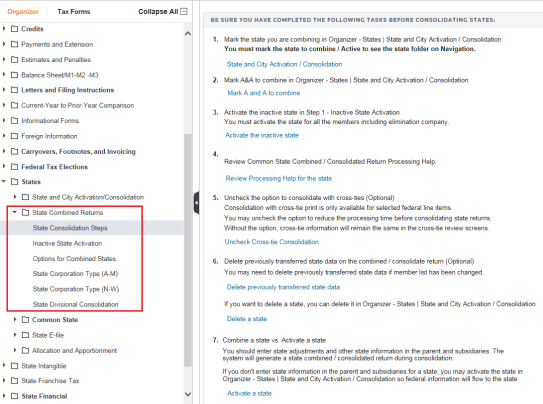

Review the task list before starting to consolidate states. The list is found in States > State Combined Returns > State Consolidation Steps.

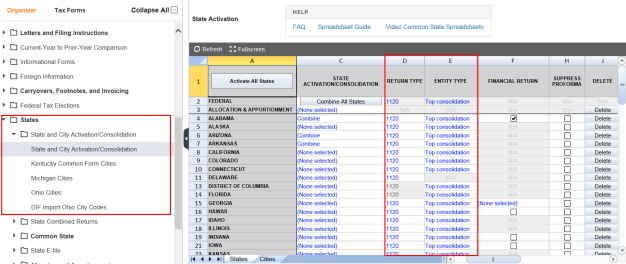

If the state Filing Status or Entity Type differs from federal, override entries on the spreadsheet in columns D and E. Click the arrow to select the item from the drown-down list.

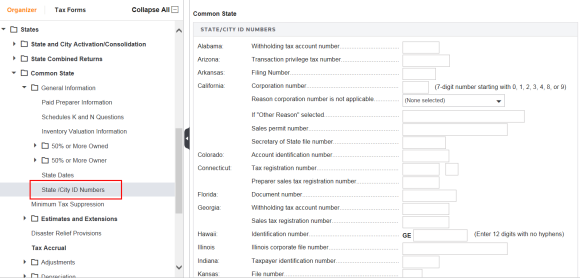

You should also enter all applicable state ID numbers on the State / City ID Numbers Organizer screen in the States > Common State > General Information folder on the Parent return.

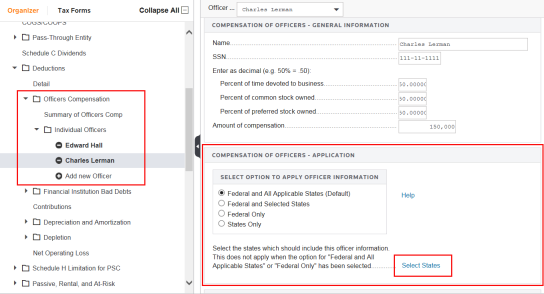

The applicable officers and directors information needs to be entered in the Individual Officers Compensation subfolder. This subfolder is located in the Organizer under Income and Deductions > Deductions > Individual Officers. Click the Select States link to select the applicable states. Scroll down to Compensation of Officers - Information for States to enter information.

Tutorials/1120_multistate_cons_common_state.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.