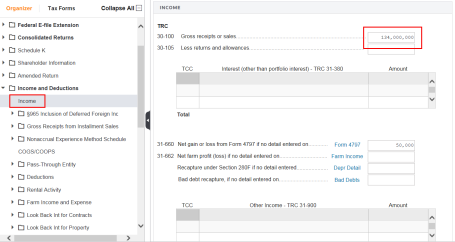

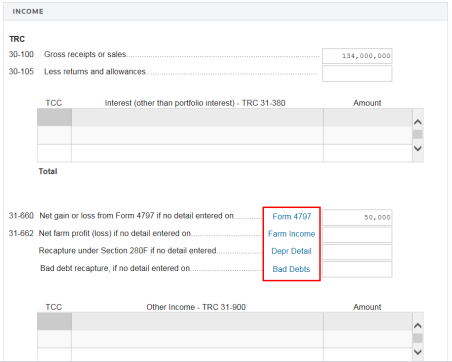

1120: Income and Deductions

The Income and Deductions folder contains a subfolder for each income and deduction item on the 1120 return. These folders are organized in the same order they are found on Form 1120, Page 1.

You can either enter total amounts on the Income and Deductions > Income screen or click the link and be directed to the applicable Organizer screen to enter detail information.

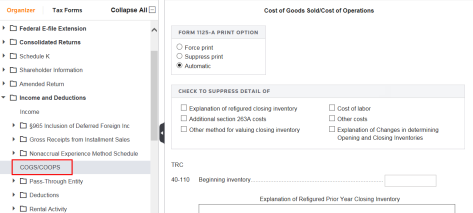

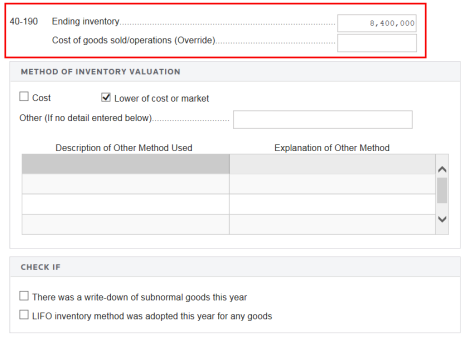

Use the COGS/COOPS screen to enter Cost of goods sold/operations data. The system uses depreciation and amortization data entered elsewhere in the return unless you make overriding entries here.

Scroll down the COGS/COOPS screen to select the Inventory valuation method. If necessary, you can override the system-calculated cost of goods sold/operations amount.

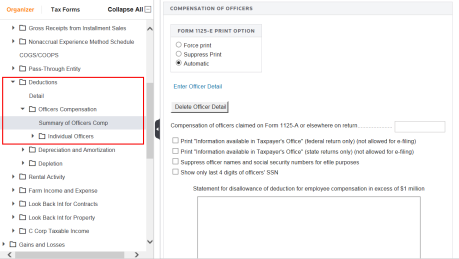

Use the Income and Deductions > Deductions > Officers’ Compensation screens to enter officer information and percent of time devoted to business.

Each income and deduction activity has its own folder and separate set of subfolders. This enables you to keep all information for a particular activity together.

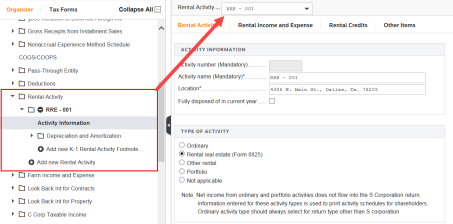

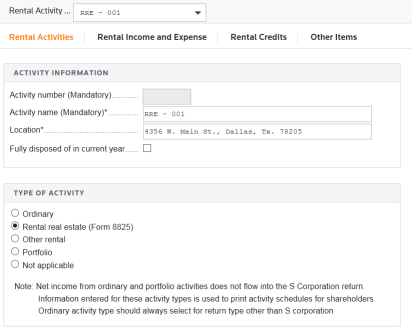

The system assigns each activity a unique Activity number to identify it. The Activity name is a required entry. When adding a new activity, you are prompted to enter this information. For pass-through entities, type the activity number and name of the partnership, estate, or trust. For Form 8825 properties, type the location of the activity.

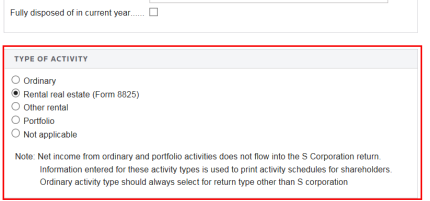

Scroll down the Rental Activities tab to select the Type of Activity. Click the applicable tabs to enter income and expenses and other information for this activity.

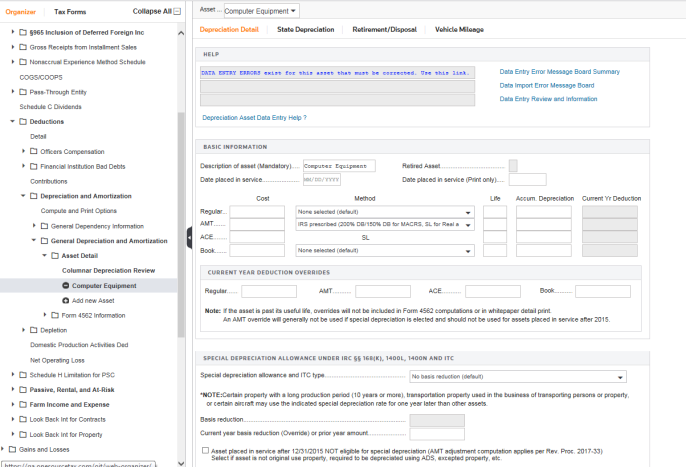

Each activity has a Depreciation and Amortization folder used to tie assets and related depreciation information to the selected activity. For more information on entering depreciation, review the Depreciation tutorial.

Tutorials/1120_income_deductions.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.