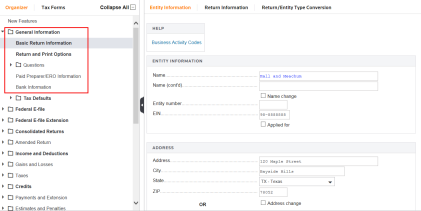

1120: General Information

Use the General Information folder to enter company information. Select your return and print options, and answer basic return questions in this area.

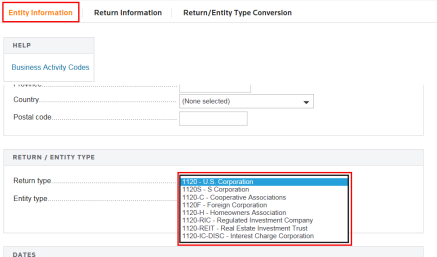

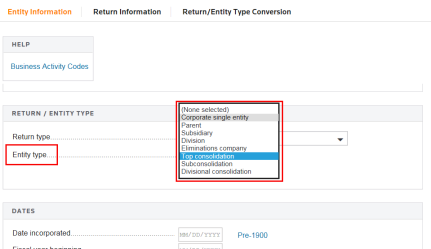

Under the Entity Information tab, scroll down the to select the Return and Entity Type for the company, the business Dates of Incorporation, and the Business Activity Code information.

Select the return type on the Entity Information tab. The selected return and entity types affect how the system treats income, deduction, and Schedule M-1 items.

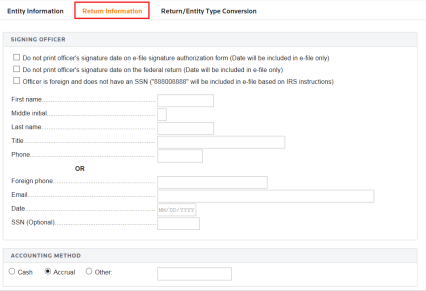

Click the Return Information tab to select fiscal dates, accounting method, and special filing information.

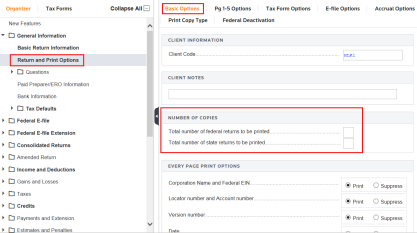

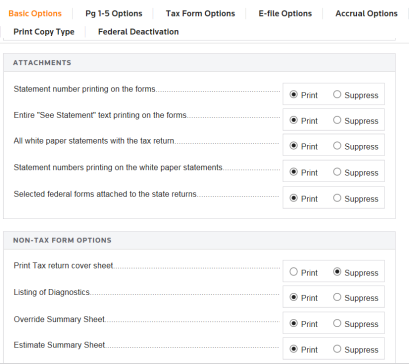

Use General Information > Return and Print Options > Basic Options to control factors such as the Number of copies, which forms/schedules print, what optional information prints on forms and attached statements, and which detail statements are generated.

These basic options are normally set up as Tax Defaults, but they may be entered (or changed) on a locator-by-locator basis on the Return and Print Options screens in the General Information folder.

Available selections on the Basic Options tab affect the entire return. These options are not specific to a particular form or schedule.

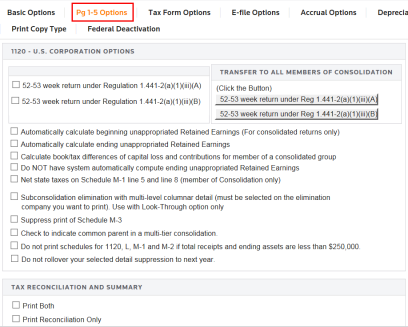

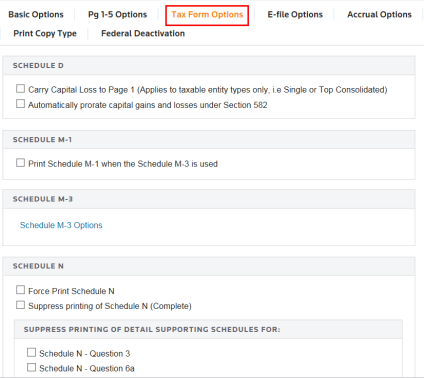

For form- or schedule-specific options, select the Pg 1-5 Options or Tax Form Options tab. Selections on these screens pertain to the computation and/or print of specific forms.

Page 1-5 Options

Tax Form Options

Printing options are defined by selection of options for various Forms and Schedules.

Tutorials/1120_general_information.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.