1120: Gains and Losses

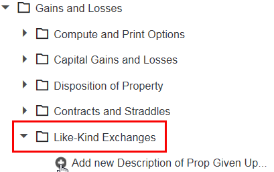

Use the Gains and Losses folder in Organizer to enter all gains and losses. Select the applicable Gains and Losses folder and choose Add New... to enter your sale information. Entries from Form 4797, Form 6252, Form 4684, and Form 6781 automatically carry to Schedule D and Form 4797 as required.

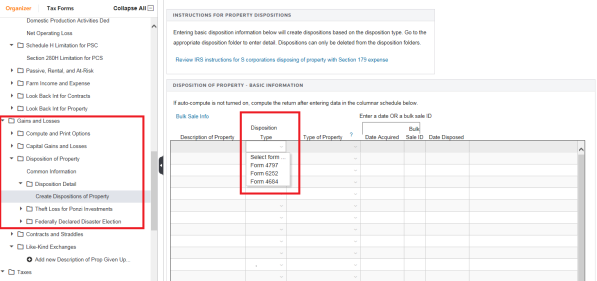

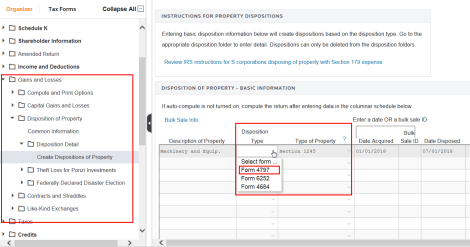

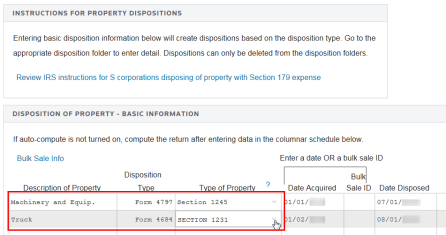

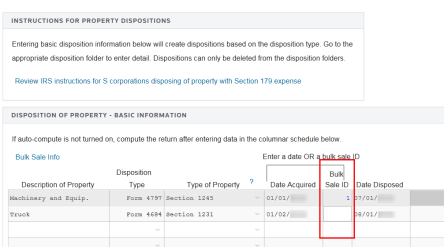

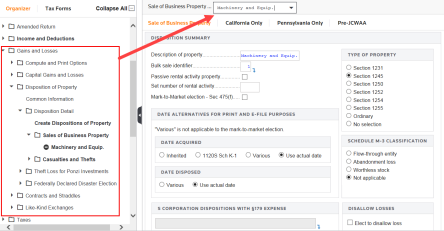

When adding properties for Sale of Business Property, Installment Sales, and Casualties and Thefts, you must go to the Disposition of Property > Disposition Detail > Create Dispositions of Property Organizer to enter a Description of property and select the Disposition Type. For example, to create a sale of business property, enter the property sold and select the Disposition Type and Type of Property from the drop-down lists.

For Capital Gains and Losses, you can either enter dates or choose a holding period. When entering Contracts and Straddles, you need to enter the applicable dates for the system to calculate the gain or loss.

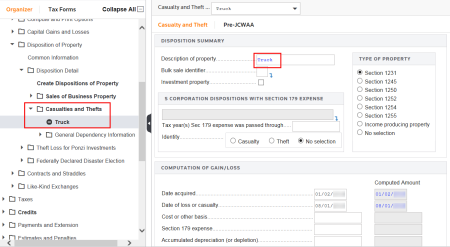

For each Casualty or Theft (Form 4684), you must enter the property description and select the disposition type as Form 4684 on the Disposition of Property > Disposition Detail > Create Dispositions of Property Organizer. Be sure to recompute.

After you recompute, a folder appears for Casualties and Thefts. If not already computed, enter the Date casualty or theft occurred and the Type of property. These are mandatory fields. If the casualty or theft results in a loss, always enter the fair market value before casualty or theft.

To automatically retire an asset from depreciation in the Sale of Business Property folder, enter a bulk sale ID number from 1 to 99. You can enter this when you create the property disposition.

On the Asset Detail Organizer for that asset, you can select the Retirement/Disposal tab to retire the asset.

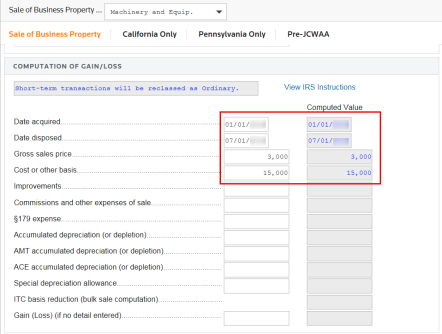

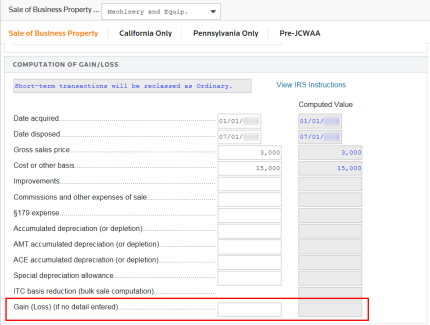

The Date acquired, Cost or other basis, Section 179 expense, and Accumulated depreciation are automatically carried to the Gains and Losses > Disposition of Property > Disposition Detail Sales of Business Property > [Asset] screen, which in this case is Machinery and Equipment. The carried in amounts will appear in blue. The amounts you enter will be in black text.

Each Gains and Losses folder has a Gain (Loss) (if no detail entered) field. This field serves as an override unless Gross sales price, cost amounts, or a Unique identifier used to retire an asset are entered.

Tutorials/1120_gains_losses.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.