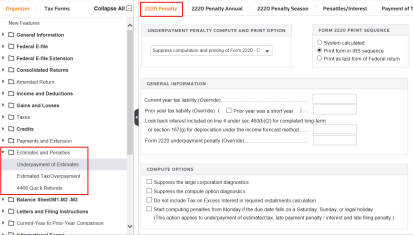

1120: Estimates and Penalties

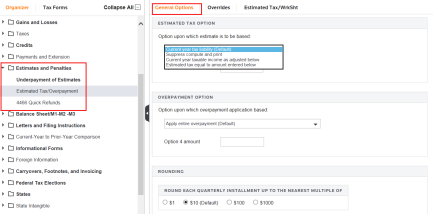

Use the Estimates and Penalties folder to select your compute and print options for estimates and underpayment/late filing penalties on a return-by-return basis. These options may also be set up in Tax Defaults.

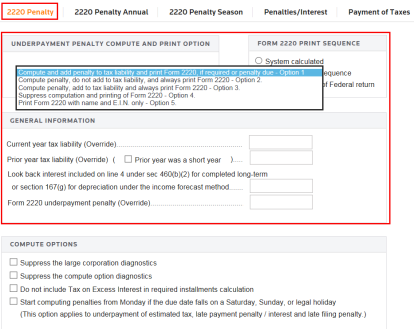

On the Estimates and Penalties > Underpayment of Estimates > 2220 Penalty screen, you may select various options for the computation of Form 2220. The system default is to compute and print Form 2220 if it is applicable in the return.

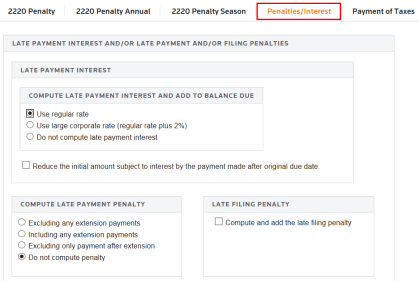

If payments were made late or the return is being filed late, it may need interest and penalties computed. On the Estimates and Penalties > Underpayment of Estimates > Penalties/Interest screen, select the interest and/or penalties to be computed.

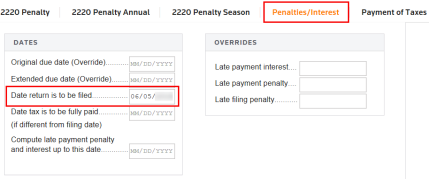

After you select the interest/penalties to be computed, you MUST enter the Date return is to be filed on the Penalties/Interest tab in the Estimates and Penalties > Underpayment of Estimates folder.

Choose the options for the computation of estimated tax and the application of the overpayment (if applicable). These options are found in the Estimates and Penalties > Estimated Tax folder.

Tutorials/1120_estimates_penalties.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.