1120: 1120S Returns

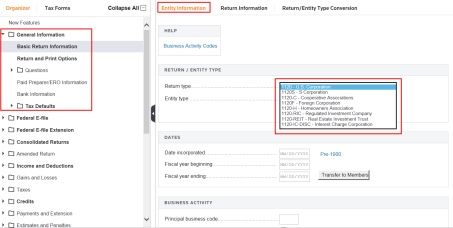

The Return Type selection under the Entity Information tab controls the folders you see in the Organizer. Selection of 1120 - US Corporation as a return type results one set of folders, as shown below.

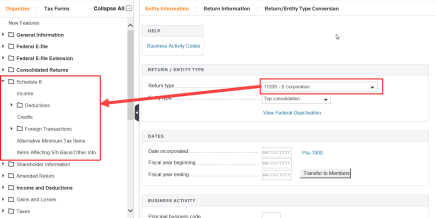

When you select 1120 - S Corporation as your Return Type, additional folders appear in the Organizer tab for you to enter, such as Schedule K and Shareholder Information.

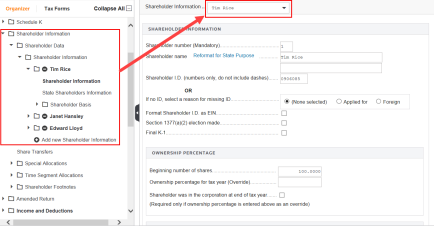

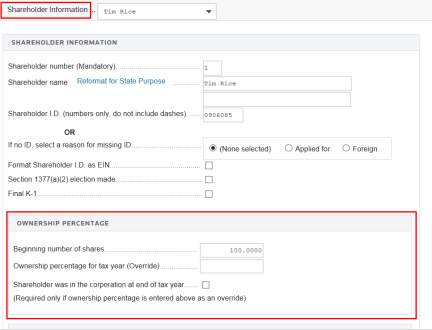

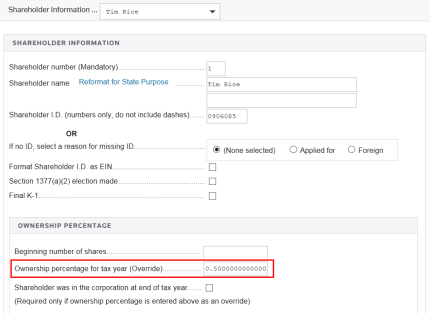

The Shareholder Information screen must be filled out in order to generate 1120S Schedule K-1s. The Shareholder number is a required entry on this screen (the name was filled in when you added the new shareholder).

You must also enter either the beginning number of shares or the ownership percentage at end of year. If a shareholder comes into the S Corporation midyear, enter None for the beginning number of shares.

If you enter the Beginning number of shares, the system takes your entered amount, plus or minus any share transfers, and computes the shareholder’s ending ownership percentage on a weighted, share-by-share basis.

If you enter an Ownership percentage for the tax year (Override), the system uses this amount to compute the shareholder’s K-1. Because this is an overriding entry, the share transfers you enter will not be taken into consideration.

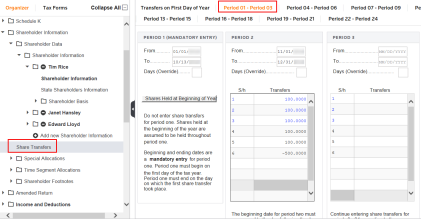

For share transfers, Period 1 must begin on the first day of the tax year and end one day before the initial share transfer. The next period begins on the day of the transfer and ends one day before the next share transfer.

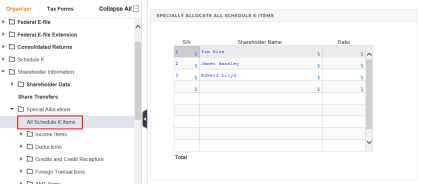

Even though each Schedule K-1 amount is based on the shareholder’s ownership percentage, you can specially allocate the K-1s, if necessary. Individual amounts or all Schedule K items can be specially allocated.

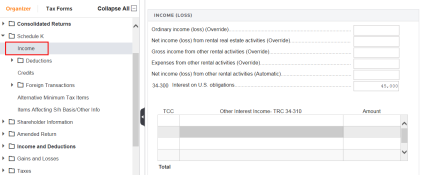

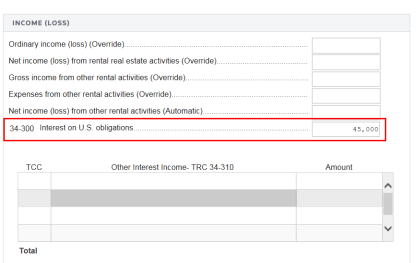

Most Schedule K amounts are computed based on your entries on other Organizer screens. You can override these amounts on the Schedule K screens.

Entries that originate from the Schedule K Organizer screen do not have (Override) after their description. These amounts do not carry in from other areas so they need to be entered on the Schedule K screens.

Tutorials/1120_1120s.htm/TY2019

Last Modified: 08/27/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.