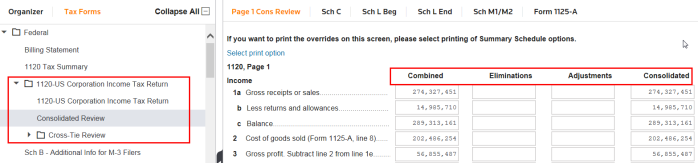

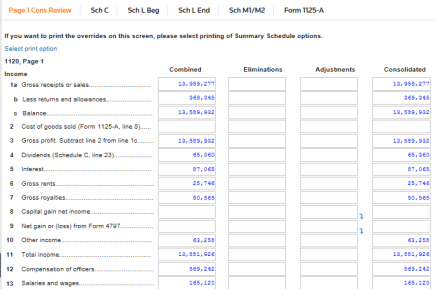

1120: Consolidation Review

Once the consolidation process is completed, you can review the Combined, Eliminations, and Adjustments columns on the Consolidation Review screens (Tax Forms > 1120-US Corporation Income Tax Return > 1120-US Corporation Income Tax Return > Consolidated Review). These review columns are available for most federal forms.

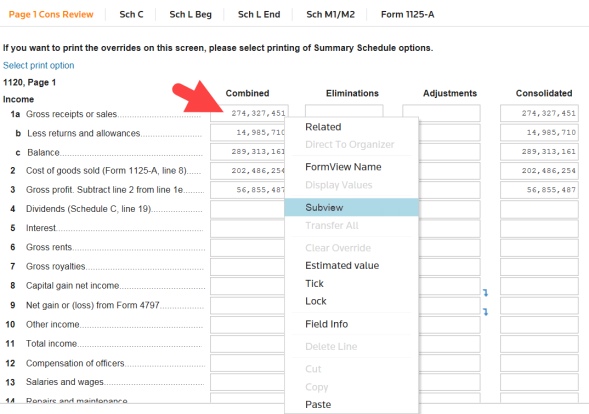

Right-click any field to access the Shortcut menu. From the Shortcut menu, click Subview.

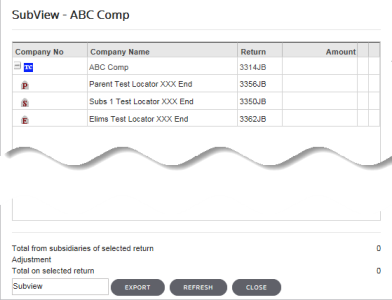

The Subview dialog box appears. The parent and subsidiaries are listed in the Subview section. Select an entity to access and review its information.

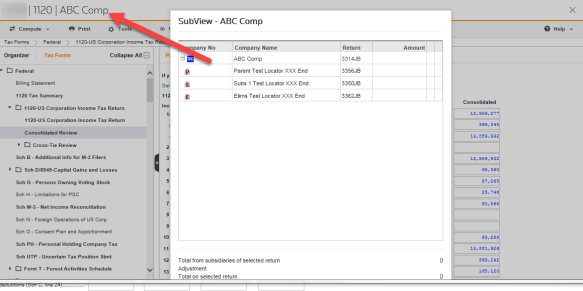

The appropriate return is automatically accessed. You can track every number from the consolidated return to the parent or subsidiary to which it relates.

You can close this return and return to the consolidation return by clicking the Close button on the Subview dialog.

You are now returned to the Consolidated Review in Tax Forms. The electronic audit trail allows you to track each number back to its source, thus reducing the time needed to review a return.

Tutorials/1120_cons_review.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.