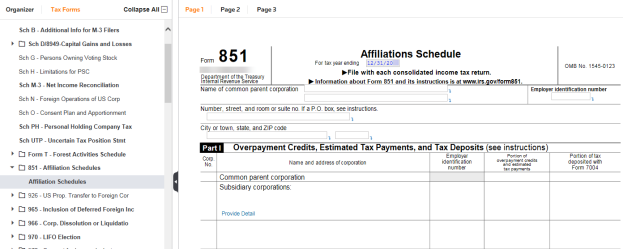

1120: Consolidations - Affiliation Schedule

On the consolidation return, use the 851 Affiliation Schedule Organizer screen to enter the information for Form 851, Part II. Part I information automatically transfers from the separate companies.

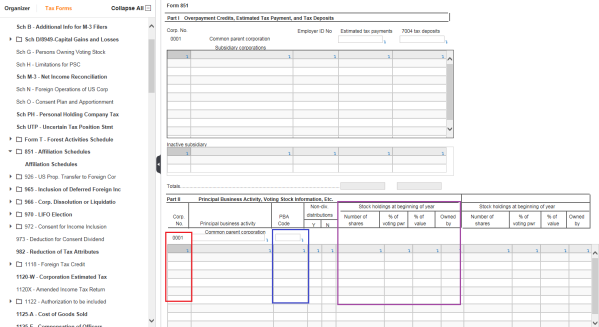

Click the Provide Detail link for Subsidiary Corporations. Review the various columns on this screen to see the information you need to enter on the consolidated tax return. If the Company No. is entered on the Consolidation Locator List screen, it will carry here automatically (see area indicated in red). When the Company No. appears, the Principal Business Activity will carry automatically from the individual companies’ Schedule K questions 2a and b (area in blue). If the Company No. appears in the column (area in red), the PBA Code will carry from the individual companies’ Schedule K questions 2a and b automatically (area in blue).

The columns outlined in purple must be entered on the consolidated tax return. Entries for these columns and the Owned by Corporation no. column, not shown here, must be entered on this screen. They will not carry in from other screens.

Tutorials/1120_cons_affiliation_schedule.htm/TY2019

Last Modified: 08/13/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.