1065: State Returns

Scroll to the bottom of the Organizer tab to the States folder.

The spreadsheet format will allow you to review common state general information across all jurisdictions at once. If a state’s entry is different than the federal entry or the entry in Common State, you can also enter the modifications in the new spreadsheet.

The Common State > Basic Return Information spreadsheets are laid out in the following format.

The Individual State rows are controlled by state activation. These rows will display data that is flowing from the federal and/or Common State and allow you to change the data on a state-by-state basis.

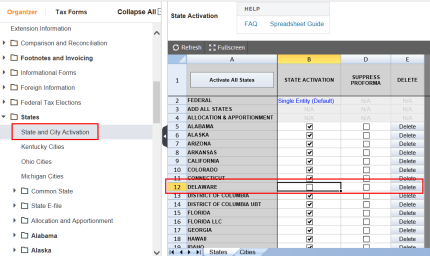

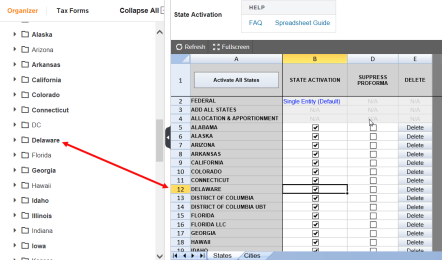

Click States > State and City Activation to view the State Grid. On the grid spreadsheet, you are able to add or delete states/cities by selecting the check box next to the desired jurisdiction.

Click the Refresh icon (  ) above column A. The added state now appears in the navigation tree under States.

) above column A. The added state now appears in the navigation tree under States.

In a similar fashion, the Common State row allows you to override federal data or enter data for fields that carry to all applicable jurisdictions that do not exist in the federal area.

Tutorials/1065_states.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.