1065: Special Allocations and Transfers

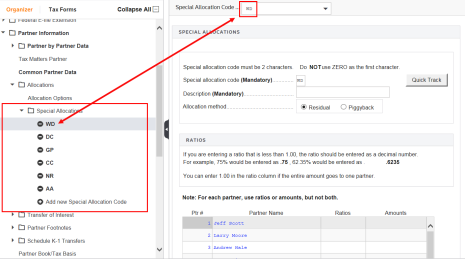

The tax application allows you to allocate many different items. From the Partner Information > Allocations > Special Allocations folder, you can access an existing special allocation code or add a new one.

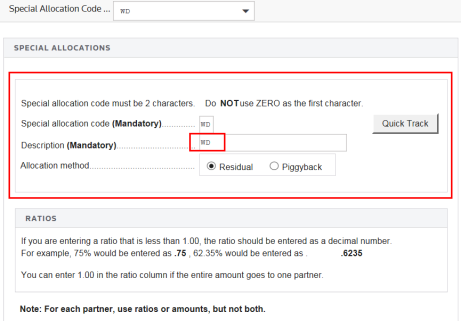

Each set of allocations has a unique 2-character code. You can also enter a meaningful description for the special allocation code. This code can be alpha, alphanumeric, or numeric. CAUTION: Do not begin the code with a zero.

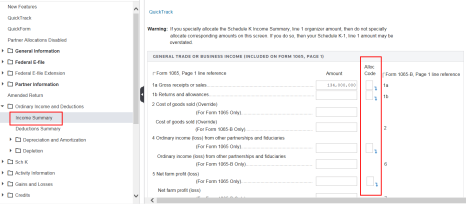

You can also access the Special Allocations screen through any of the allocable items in the federal and state areas by selecting the Alloc Code column.

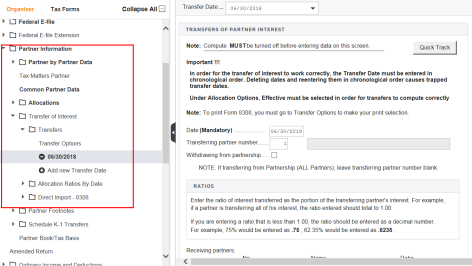

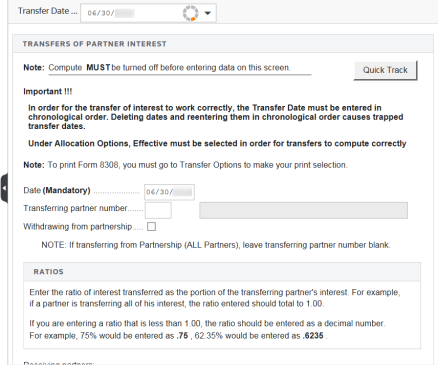

Transfers of interest can be made from one or more partners to one or more partners. To begin, select Partner Information > Transfer of Interest > Transfers > Add New Transfer Date.

If not distributing a partner’s share to all remaining partners, enter the receiving partner(s) information in these fields.

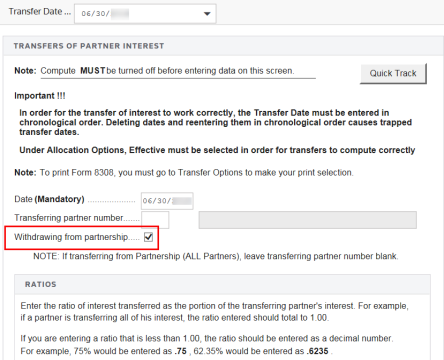

If a partner is withdrawing from the partnership, you only need to enter the transferring partner’s number. If a partner is transferring all of his interest to the partnership (all partners), you only need to enter the transferring partner’s number. The tax application transfers his interest to all partners in the return. You also need to select the Withdrawing from partnership check box.

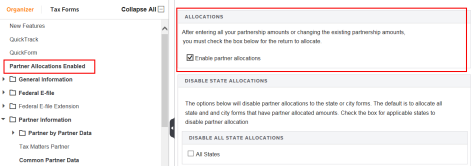

To maximize the efficiency of the 1065 tax application, it is recommended that you not enable allocations until after you enter all data for the partnership. You can access the Enable Partner Allocations screen from the Forms List Window. After you check the box on the Enable Allocation screen, you must change the focus of the field before the enable allocations option is recognized.

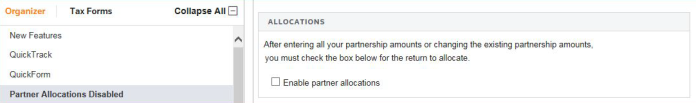

If partner allocations are disabled, you will see this appear in the navigation pane.

Tutorials/1065_special_allocations.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.