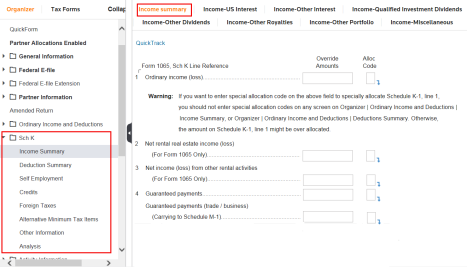

1065: Schedule K

The Schedule K folder contains several subfolders for each section of the actual Schedule K form. Most of the information in the Schedule K folder are overrides of computed amounts entered elsewhere in the return.

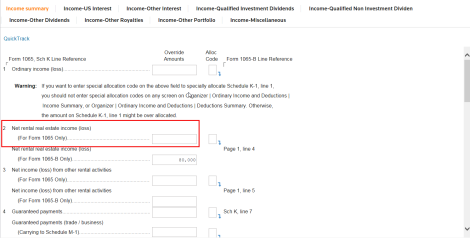

For example, an entry on line 2 for Net rental real estate income (loss) overrides information entered in the Activity Information folder for rental real estate activities.

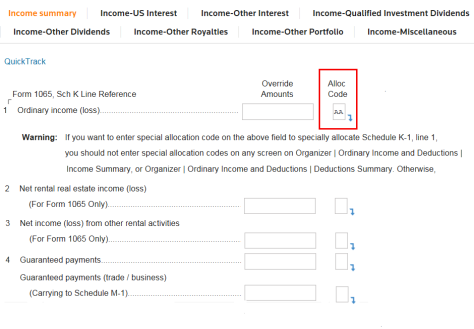

You can also use the Schedule K folder to specially allocate items on Schedule K. Below, special allocation code AA was entered on line 1 for Ordinary Income.

When the partnership computes and allocates the return, the amount of ordinary income entered elsewhere in the return is allocated by the ratios/dollars set up for special allocation code AA. A dollar amount does not have to be entered on line 1 unless you want to override the total amount computed by the system.

Tutorials/1065_Schedule_K.htm/TY2019

Last Modified: 08/27/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.