1065: Partner Information

The Partner Information folder contains all of the information for the partners. Partner information can be bridged in, rolled over from a prior year’s return, or entered directly into the Organizer.

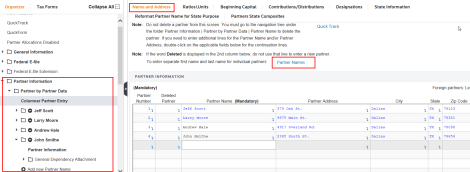

When you open this folder, all of the existing partners appear under the Columnar Partner Entry. You can select an existing partner or choose to add a new partner. These selections can be made either in the Forms List Window or by clicking the Partner Names link.

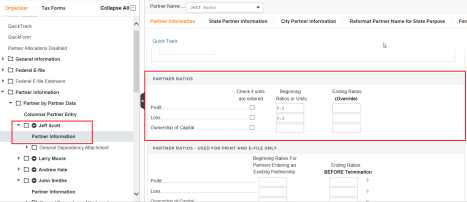

Select one of the partner names. Scroll down the Partner Information screen to enter the beginning capital and ratios for the selected partner.

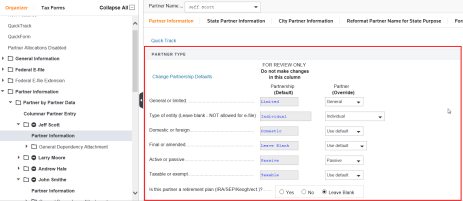

Scroll down farther to select the Partner Type options applicable to the selected partner. Your choices here override the default selections made on the Common Partner Data screen.

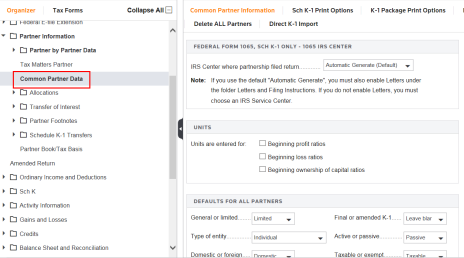

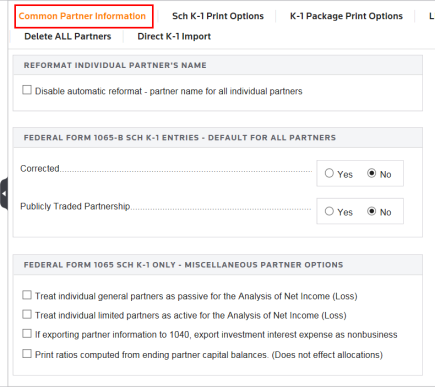

The Common Partner Data folder contains information for all partners. This feature is very helpful for partnerships with a large number of partners. Specific partner information can be entered in the Partner by Partner Data folder.

Scroll down the Common Partner Information screen to enter the default types for all partners. You can find the miscellaneous partner options at the bottom of the screen.

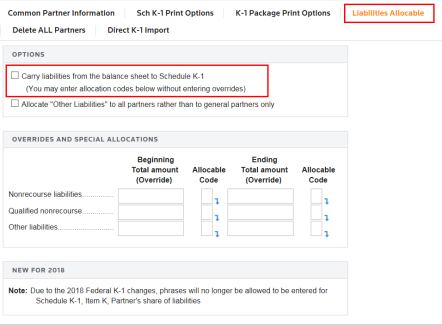

To carry liabilities from the balance sheet to Schedule K-1, select the check box under the Liabilities Allocable tab.

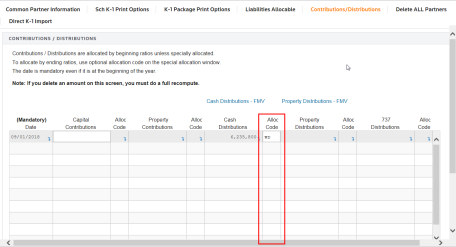

Click the Contributions/Distributions tab. Contributions/Distributions are allocated by beginning ratios unless specially allocated on this screen. Enter the date in the first column and the amount in the appropriate column. Enter a special allocation code, if necessary. To specially allocate an item differently than the ratios already set up in the partner information screen, enter a 2-character code in the Allocation Code field.

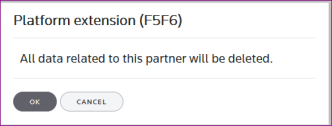

To delete a partner, select the  symbol next to the partner name in the navigation. When you click OK on the following screen, all data related to that partner will be deleted.

symbol next to the partner name in the navigation. When you click OK on the following screen, all data related to that partner will be deleted.

Tutorials/1065_partner_info.htm/TY2019

Last Modified: 08/27/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.