1065: General Information

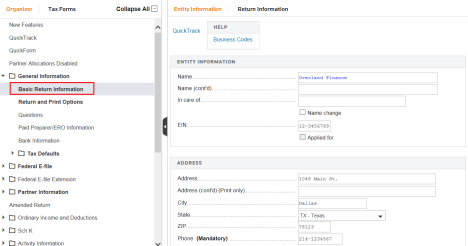

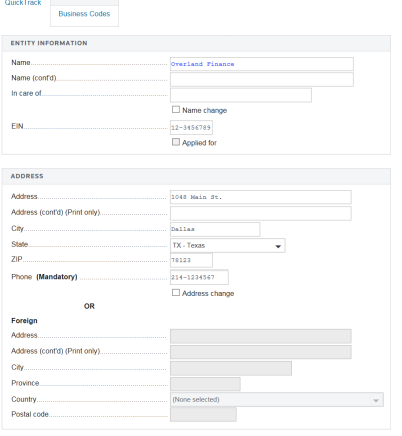

The General Information folder is where you enter basic return data and select your default return and print options. Click the Basic Return Information item on the navigation tree and select the Entity Information tab.

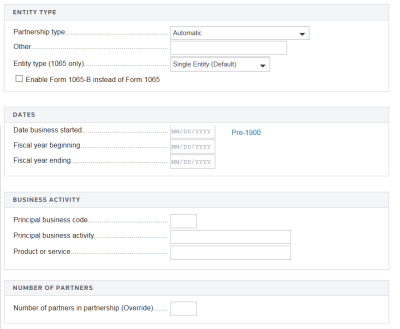

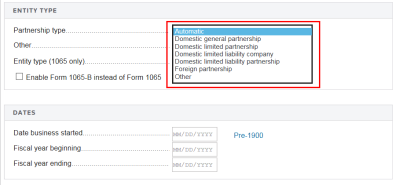

Scroll down the Entity Information screen to enter business activity information, including the Partnership type (from the drop-down list), fiscal year dates, and number of partners. The fiscal-year dates print on Form 1065. These dates are also used to correctly compute gains and losses, depreciation, and so forth.

Select the Partnership type from drop-down list. Automatic is the default. You can also answer questions about the partnership here. These answers will print on Form 1065.

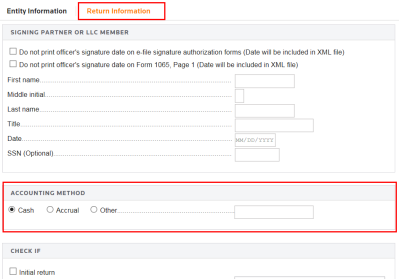

Click the Return Information tab, and on the screen, select the accounting method and other options. If you leave the accounting method blank, the system defaults to the Cash option.

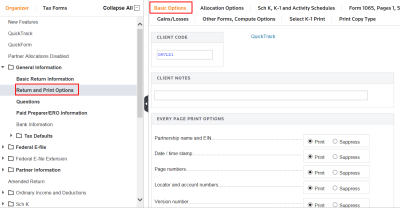

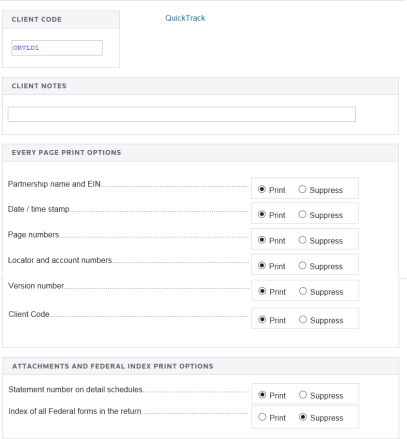

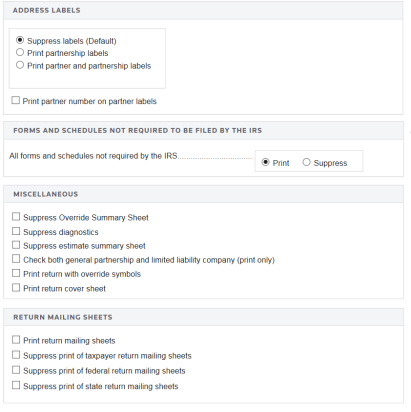

On the Return and Print Options > Basic Options screen, you can choose from many return and print options. These selections provide you with the ability to customize the preparation and print of your 1065 returns.

You can set most options as tax defaults for the entire account. If defaults have been set, they appear when you compute the return unless you override them here. If you make no entries and set no defaults, the system uses its own defaults for that item.

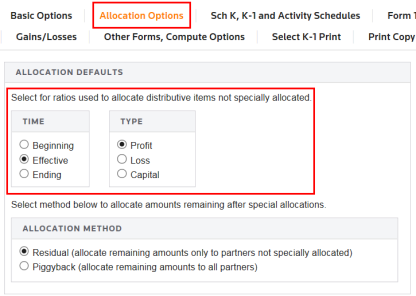

It is very important to specify how you want distributive items allocated to Schedule K-1 for each partner. If no selections are made, the system defaults, shown below, are used.

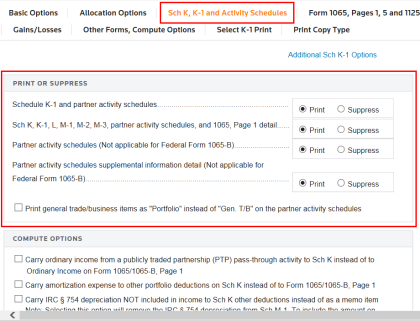

Under the Sch K, K-1 and Activity Schedules tab, you can select K-1 print options. You can also choose to print or suppress the Schedule K-1s and the supporting detail schedules from this screen.

Also under the Sch K, K-1 and Activity Schedules tab, return and print options are available for most 1065 forms and schedules. You should review these screens carefully to take advantage of the many options available for Partnership tax returns.

Tutorials/1065_general_info.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.