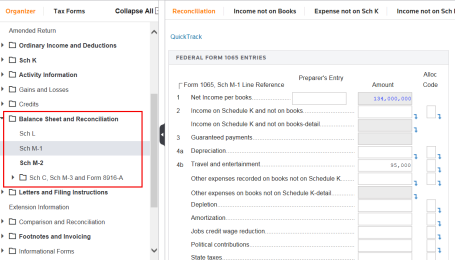

1065: Balance Sheet/Reconciliation

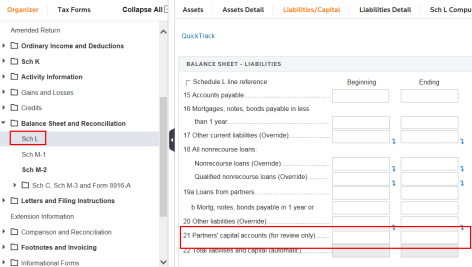

The Balance Sheet and Reconciliation folder contains information for Schedules L, M-1, M-2, M-3, Schedule C, and Form 8916-A.

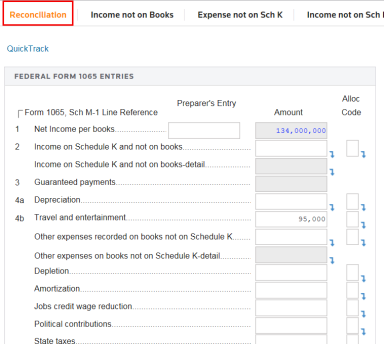

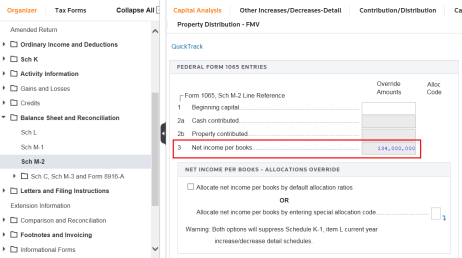

To balance the return, we compute Net Income per Books shown below on Schedule M-1 and carry this amount to Net income per books shown on Schedule M-2. The system automatically computes the net income per books amount from entries made in the return.

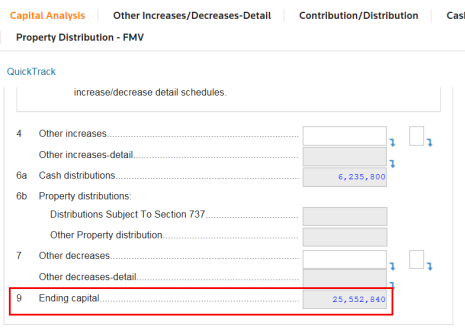

Your ending analysis of partners’ capital balance on Schedule M-2, line 9 below should equal your ending partners’ capital on Schedule L, line 21. If these amounts do not equal each other, your return is out of balance. If these schedules are out of balance, a diagnostic message appears to warn you of this situation.

Your ending analysis of partners’ capital balance on Schedule M-2, line 9 below should equal your ending partners’ capital on Schedule L, line 21. If these amounts do not equal each other, your return is out of balance.

Tutorials/1065_balance_sheet.htm/TY2019

Last Modified: 08/27/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.