1041: Income and Deductions

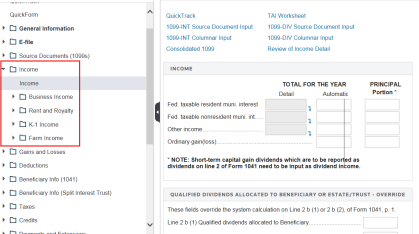

The Income folder contains a subfolder for each income item on the 1041 return. These folders are organized in the same order they are found on Form 1041. To enter detail for income items, select Income > Income.

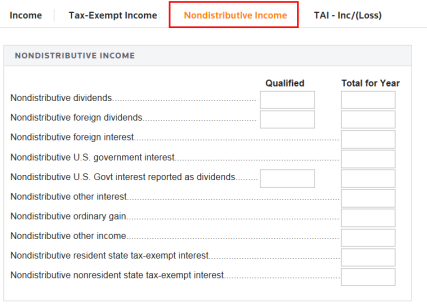

You can enter detail for income items or an override amount. To enter detail, select the gray box for the item you want to detail. You can also select the Tax-Exempt Income or Nondistributive Income tabs to enter amounts, as shown below.

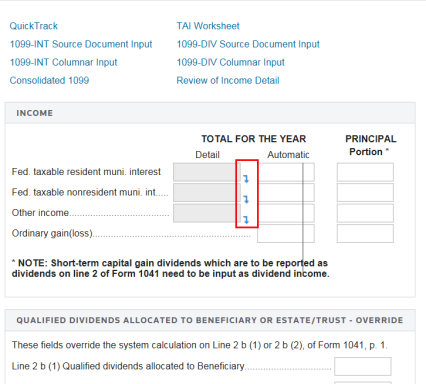

The detail drill-down hyperlinks (bent blue arrows) take you to a new screen to enter detail information for the selected item.

On the Income > Income screen, click the Review of Income Detail link to access the detail screen.

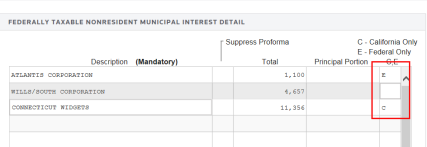

The descriptions and amounts you enter will print on a detail whitepaper statement. To indicate that an item should be excluded from start-over states, enter an E in the right column. A C in the right column indicates that the item should go to the California state return only. If this field is left blank, the item goes into the federal calculations and all states.

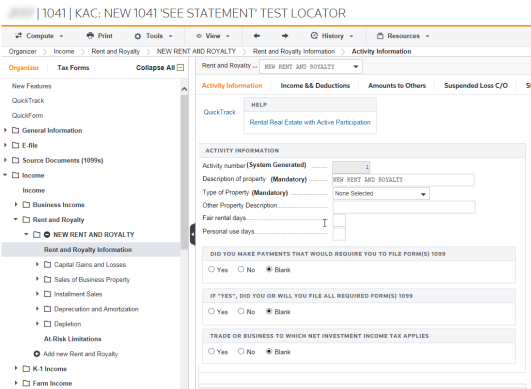

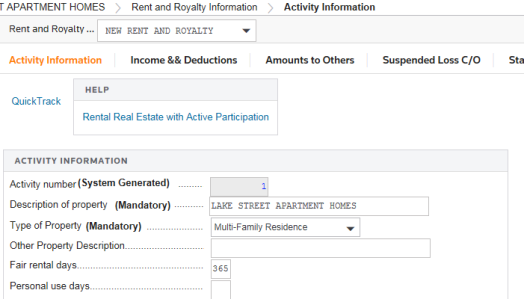

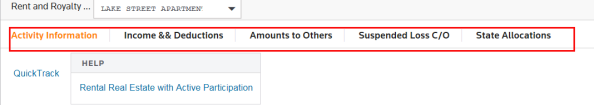

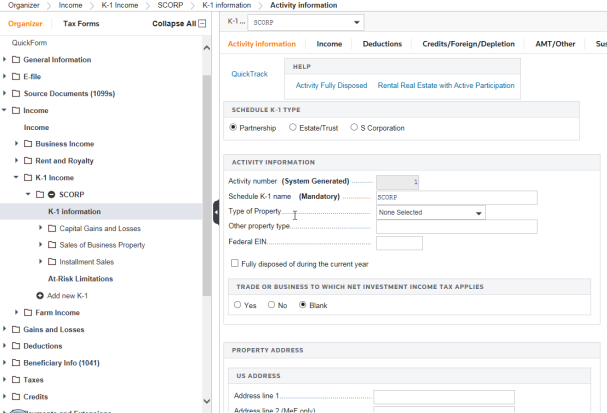

Each income activity has its own folder and separate set of subfolders. This enables you to keep all information for a particular activity together.

You must assign a description to each activity (mandatory).

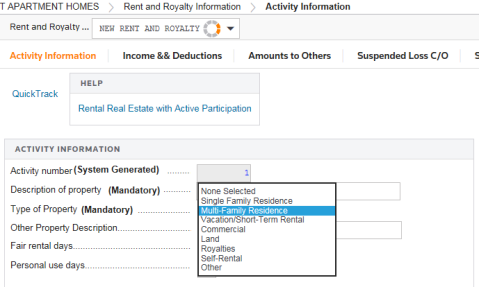

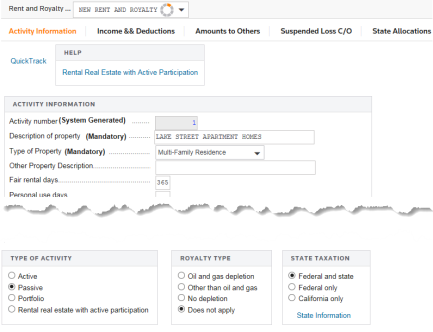

Also on the Activity Information tab, select the mandatory Type of Property. The system automatically generates the Activity Number.

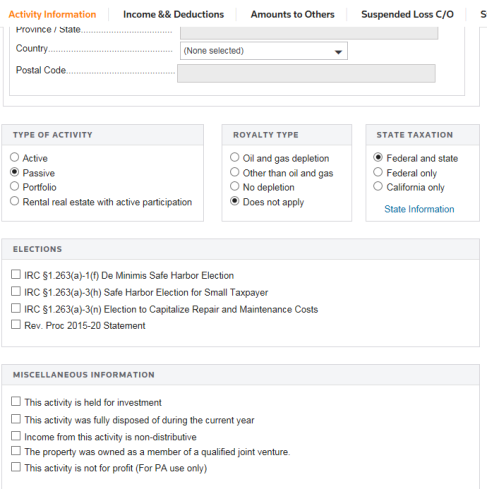

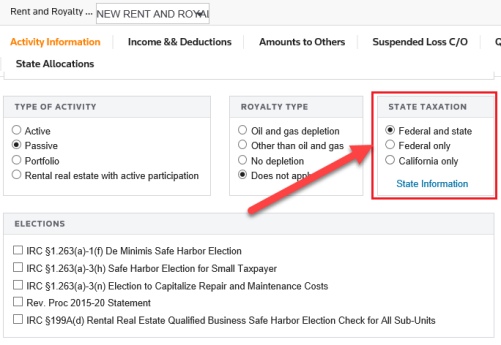

You can also select how you want this activity treated for state taxation purposes. The default is to include the activity in the federal and state returns by scrolling down to the Type of Activity section and select one of the option buttons.

Notice the tabs across the top of this form. To enter income and deductions and additional information for this activity, select the applicable tabs.

The check boxes shown provide special options.

- Activity is held for Investment: The system carries rent and royalty income, investment interest expense, and other investment expenses related to the computation of net investment income.

- Activity was fully disposed of during the current year: The system fully recognizes all gain or loss realized on the disposition with no limitation.

- Income from this activity is non-distributive: All amounts from this activity included in the calculation of distributable net income will be treated as non-distributive.

- Other check boxes for special options are also available on this screen.

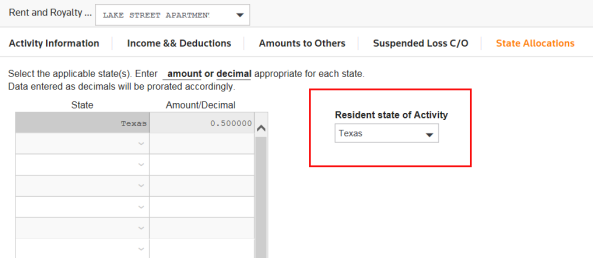

The residency status you select here is not used in determining the amounts that carry to the attached state returns. To enter state information, select the State Information link.

When you click the State Information link, you see the screen where you can enter information for state activity in relation to this activity. Your entry in the State Residency list box is used in conjunction with the passive/active detail statement generated from the Print Options tab on the General Information > Return Print Options > Irrevocable screen.

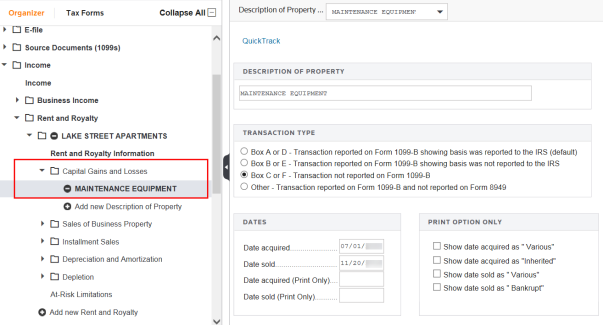

Capital gains (losses) related to an activity should be entered in the Capital Gain (Loss) folder for that particular activity.

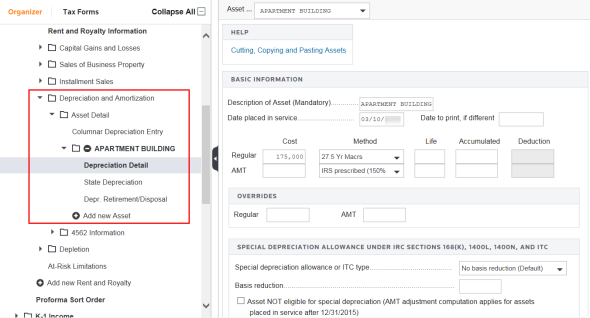

Each activity has a Depreciation and Amortization folder used to tie assets and related depreciation information to the selected activity.

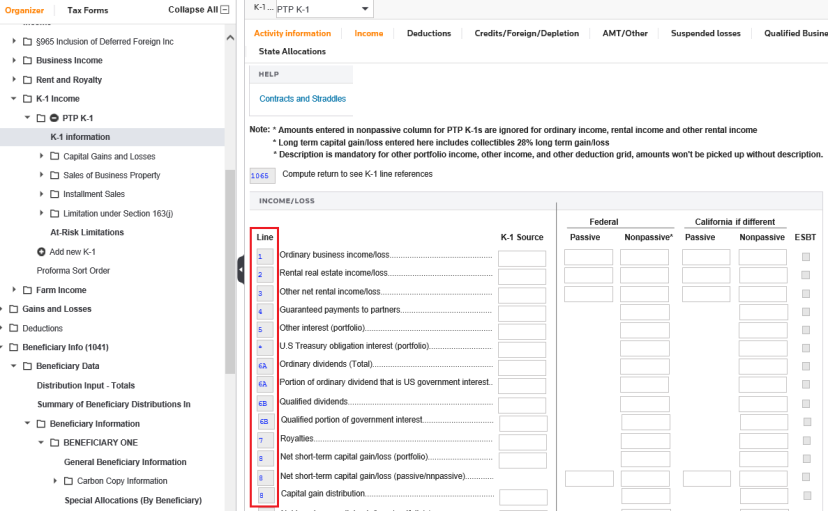

To assist you with entering K-1 data in the Income and Deductions > K-1 Income folder, the line items from Schedule K-1 are listed. Note the line numbers outlined below.

Income and loss amounts entered on the K-1, Page 1 and 2 tabs are netted with other amounts from these screens. The result of this calculation is the operating income or loss from this activity.

The following K-1 items are netted with income (loss) amounts to calculate operating income (loss):

- Rental real estate income (loss)

- Other rental income (loss)

- Other income (expenses)

- Depreciation

- Depletion and Amortization.

Tutorials/1041_income_deductions.htm/TY2019

Last Modified: 08/13/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.