1041: General Information

Use the General Information folder to enter basic return data and select your default return and print options.

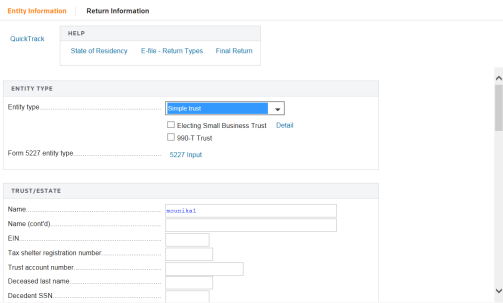

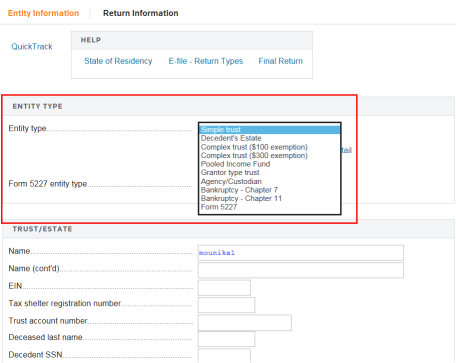

On the Entity Information screen, enter the Entity Type at the top of the screen. You can read the list to see all options that are available. If no type of entity is selected, the system defaults to Simple trust.

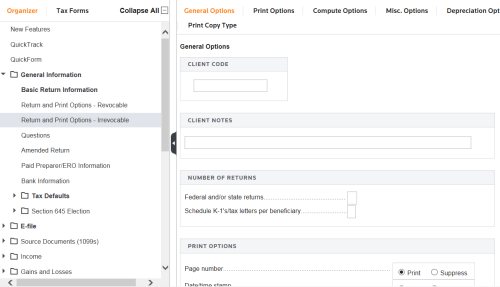

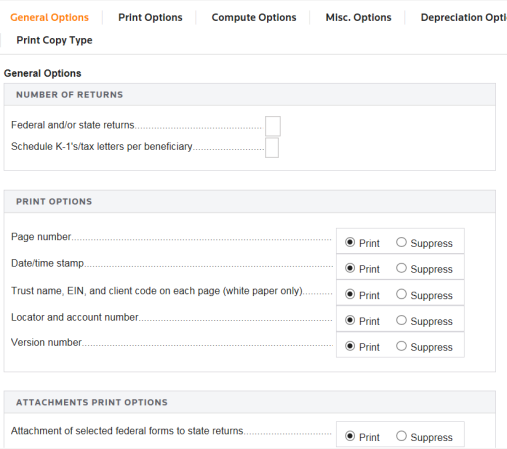

Select Return and Print Options - Irrevocable from the menu. You have a large selection of return options to choose from in the Return and Print Options folder. With these, you can customize the preparation and print of your 1041 returns.

Most options can be set as tax defaults for the entire account. If defaults have been set, they will appear when you compute the return unless you override them on these tabs. If you make no entries and set no defaults, the system uses its own defaults for that item. You should review these screens carefully to take advantage of the many options available for fiduciary tax returns.

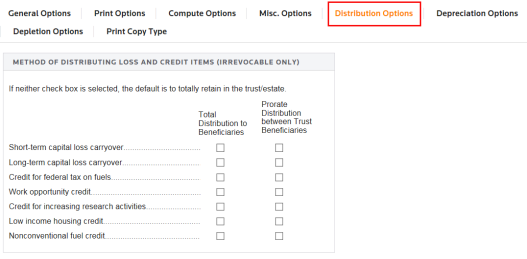

Use the Distribution Options tab to determine how you want loss and credit items distributed for irrevocable accounts. The system default is to retain these items in the trust.

Tutorials/1041_general_information.htm/TY2019

Last Modified: 08/27/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.