1041: Beneficiary Messages

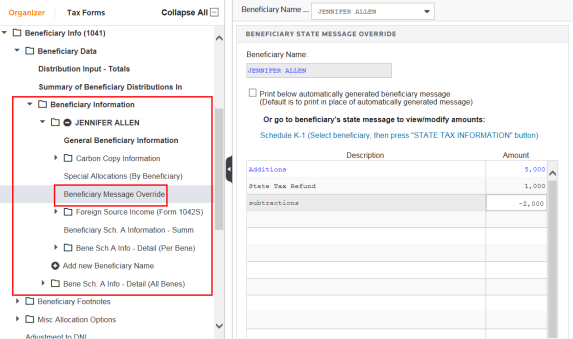

You can use the system-generated beneficiary message or create your own customized message for each beneficiary. To customize your message, select the Beneficiary Message Override screen from the Beneficiary Info (1041) > Beneficiary Data > Beneficiary Information folder.

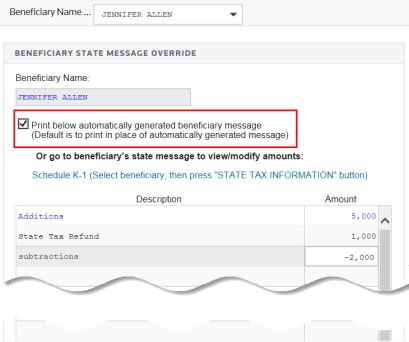

The custom message can be printed instead of or in addition to the automatically generated message on the state tax information portion of the Tax Information Letter or Grantor Letter. The state tax information portion of a Tax Information Letter or Grantor Letter provides information that the beneficiary reports on the personal state income tax return. This information includes adjustments to federal amounts (for adjustment states) plus other types of information.

Enter the descriptions and amounts as you want them to appear on the letter. If you want to print this information in place of the automatically generated message, select the print option at the bottom of the screen.

Tutorials/1041_beneficiary_messages.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.