1041: Beneficiary Distributions

Use the Beneficiary Info folder to indicate the total distributions to all beneficiaries, identify each beneficiary, and indicate the amounts of income and/or capital gains distributed to each beneficiary.

The system automatically retains all capital gains (losses) within the trust/estate except when one or more of the following occurs:

- A trust/estate is terminated.

- A capital gain distribution is made.

- A special allocation of capital gains (losses) is made.

- An option has been selected to distribute capital loss carryovers.

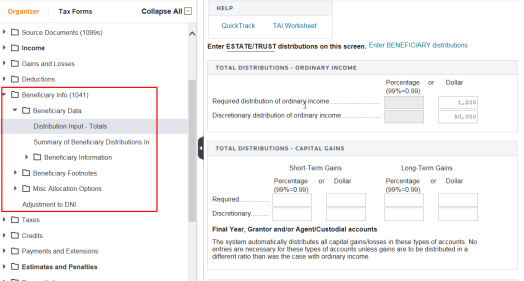

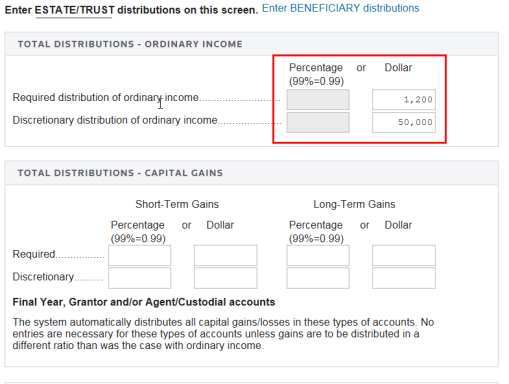

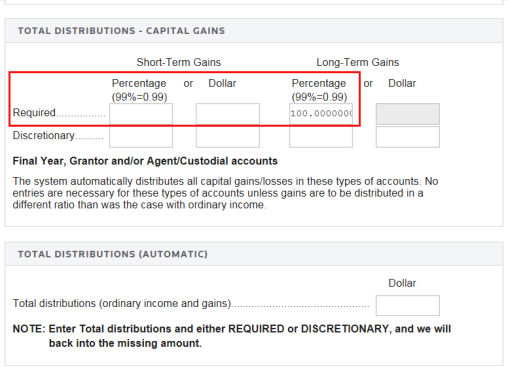

Use the Beneficiary Info > Beneficiary Data > Distributions Input - Totals screen to enter the total income and capital gains to be distributed. Entries must be made on this screen if amounts are being distributed to beneficiaries.

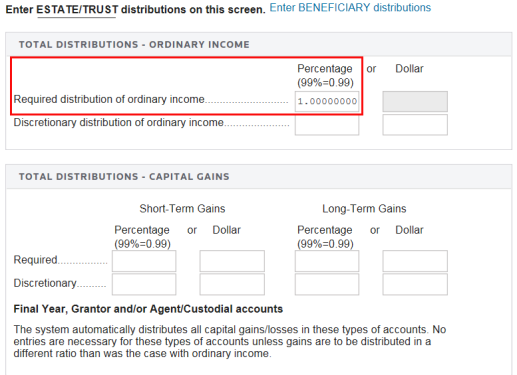

The amounts or percentages entered on the Distributions-Totals screen are the totals for the entire trust and refer to the distribution of Distributable Net Income (DNI) exclusive of capital gains. In the percentage fields, enter 100 for 100%; 1.0 will be computing as 1%.

For simple trusts, grantor trusts, agent/custodian accounts, and final year returns, 100% must be entered for the Required Distribution of Income, since all income must be distributed currently.

This is the total distribution for all the beneficiaries combined; the remaining income will be retained in the trust.

For final year returns and revocable accounts, capital gains are automatically distributed (100%) to the beneficiaries using the same ratios as income distributions. No entries are required here. Capital gains are distributed to beneficiaries using the income distributions ratios unless entries are made on the individual beneficiaries’ Bene Name/Address/Distribution Info screen.

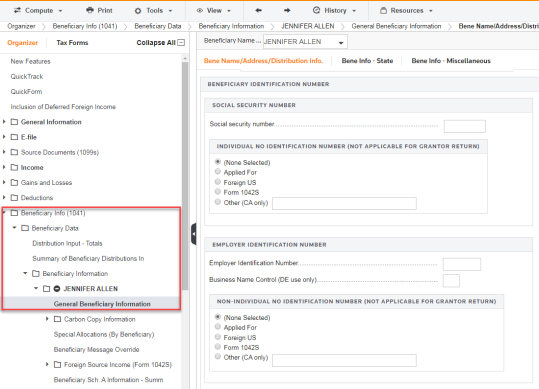

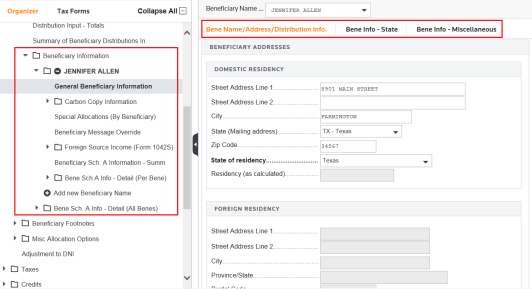

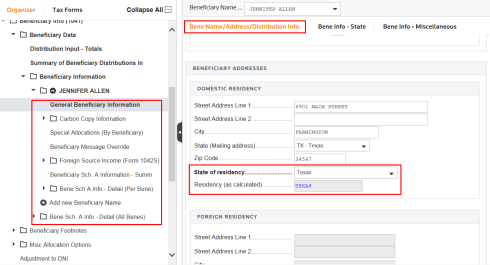

The Beneficiary Information folder contains sets of subfolders for each beneficiary. Select a tab in the General Beneficiary Information folder to enter individual beneficiary information and distributions.

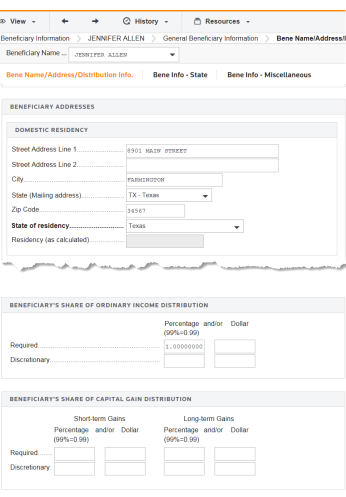

Use the Bene Name/Address/Distribution Info screen to enter this beneficiary’s share of the required and discretionary distributions which were entered on the Distributions-Totals screen. Percentages entered here represent what percentage of the total required/discretionary distribution this beneficiary is to receive.

The sum of all beneficiary percentage entries for each category of distributions (required/discretionary) must add up to 100%; otherwise, the system will prorate the percentage entries among the beneficiaries.

State Tax Information

The system uses the resident state selected to determine the following:

- beneficiary state messages for Schedule K-1 and/or tax letters

- answers to residency questions on certain state returns

- resident versus nonresident beneficiary status for certain state returns

- state name to be printed in the body of the beneficiary letter, if any.

On the Bene Name/Address/Distribution Info tab, choose the state of residence for each beneficiary. If no resident state is selected, the system default is to use the same resident state as the fiduciary.

Tutorials/1041_beneficiary_distribution.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.