1040: Passive Losses - Prior Passive Activities

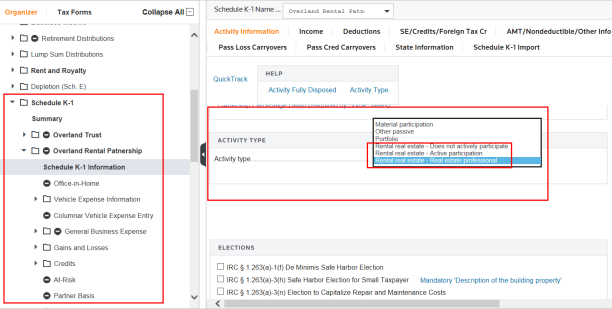

Taxpayers can potentially qualify to treat some or all of their nonpassive activities as former passive activities. The activity type must be a nonpassive activity type and there must be passive loss carryovers on the Passive Loss Carryovers tabs.

The prior-year disallowed loss of a former passive activity is allowed to the extent of the net income from the activity, with the remainder subject to passive activity loss rules.

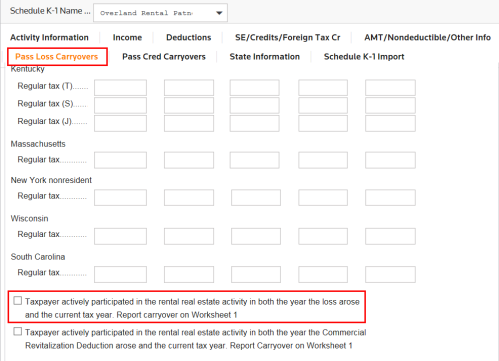

Select the Taxpayer actively participated in the rental real estate activity in both the year the loss arose and in the current tax year option on the Passive Loss Carryovers tab to report prior-year disallowed loss on Worksheet 1 of Form 8582. This loss will also be eligible for the special allowance for rental real estate with active participation. If this field is not checked, the passive loss carryover will be reported on Form 8582, Worksheet 3.

Tutorials/1040_passive_prior.htm/TY2019

Last Modified: 08/26/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.