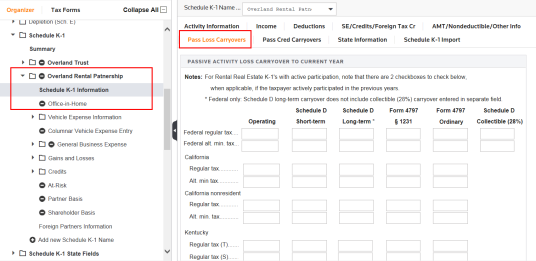

1040: Passive Loss Carryovers

The Passive Loss Carryovers tab is accessible from any activity where suspended losses can occur. All carryovers are used in the calculation of allowable current-year income (loss) from a passive activity.

Ordinary loss carryovers and carryovers from Schedule D and Form 4797 should only be entered on the Passive Loss Carryovers tab. The carryovers should not be entered on Form 8582 workpapers. The Passive Loss Carryovers tab is available for the following activities:

- Business Income (Schedule C)

- Schedule K-1 Information

- PTP Schedule K-1 Information

- Rents & Royalty

- Farm Income

If an activity is not disposed of in the current year, suspended loss carryovers are allowed to the extent of current year passive income.

If an activity is fully disposed of in the current year, all suspended loss carryovers are allowed in full.

Tutorials/1040_passive_loss_carryovers.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.