1040: Passive Losses - Activity Disposition

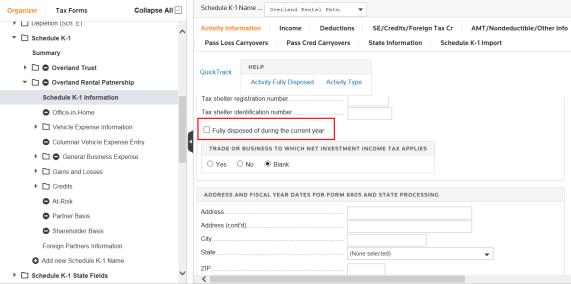

To indicate that an activity is fully disposed, you must check the check box on the Activity Information tab. This check box triggers the automatic passive disposition treatment and allows all suspended losses to be used. The tax application automatically recognizes the suspended loss carryovers and calculates Form 8582.

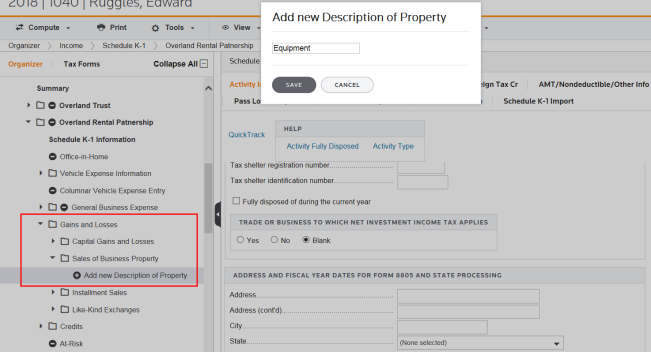

Each activity has a Gains and Losses folder used to record the gains or losses from the disposition of the activity.

In this example, we will illustrate the disposition as the sale of business property. To add the activity to this folder, click Add new Sale of Business Property, and enter the name of the activity being disposed of.

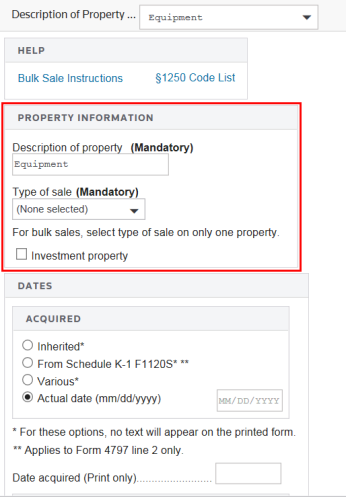

You must select the Type of sale; this is a mandatory entry.

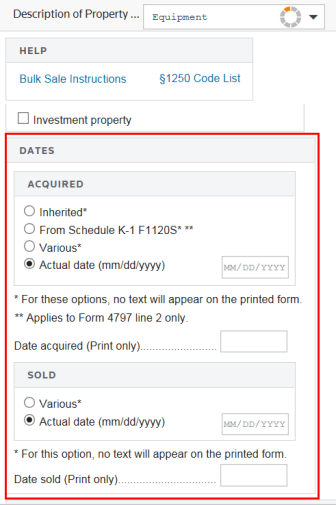

Enter the Date acquired and Date sold in the applicable fields.

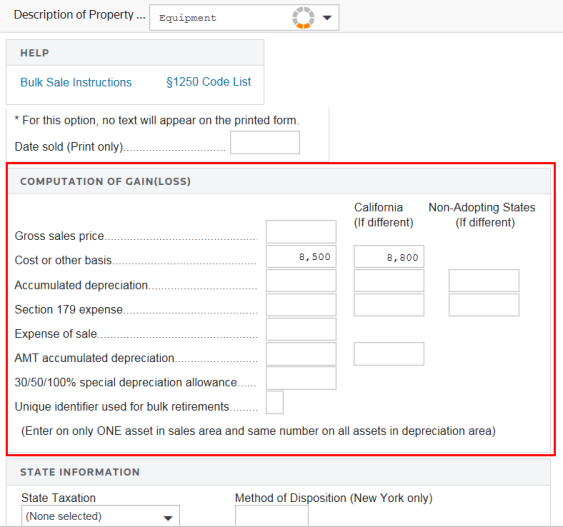

Scroll down the Sale of Business Property screen to enter the Gross sales price and the Cost or other basis in the fields provided.

If the entire interest in a passive activity is disposed of in a fully taxable disposition to an unrelated party, the following computations are made:

- If the disposition results in an overall loss, the losses in the year of disposition are allowed in full.

- If there is an overall gain on the disposition, the income (loss) amounts carry to Form 8582 and the gain is used to offset passive losses from other activities.

Gains and losses on dispositions of less than an entire interest carry to Form 8582 and are subject to the passive activity loss rules.

To determine overall loss, combine all current-year income (loss) associated with the activity and the activity’s suspended losses. Gain (loss) on the disposition is not subject to the passive activity rules and does not carry to Form 8582.

Tutorials/1040_passive_disposition.htm/TY2019

Last Modified: 08/13/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.