1040: Passive Losses - Data Entry

For any activity that can have passive income, use the fields provided on the Activity Information tab of the Organizer to specify the activity type and participation level for the property. The following activities can have passive income:

- Business Income

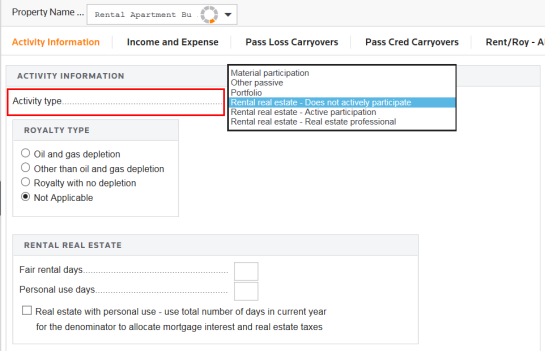

- Rent and Royalty

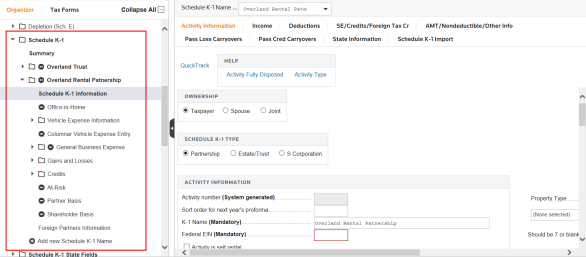

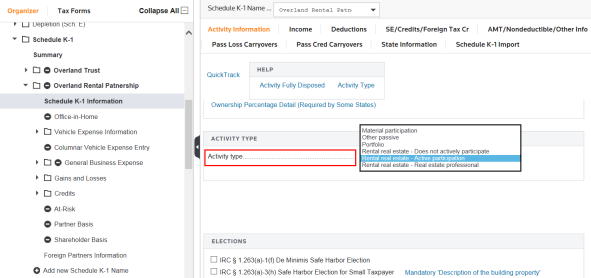

- Schedule K-1

- Schedule K-1-PTP

- Farm Income

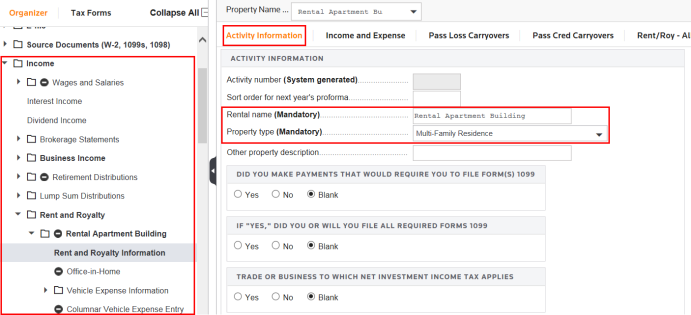

This is the Activity Information tab for rental property. You must enter a description in the Rental Name field, select the Property type, and enter an address in the address fields; these are required entries.

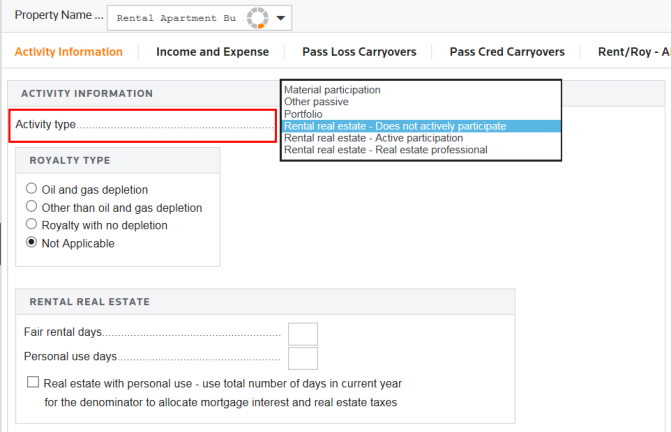

Scroll down the Activity Information group box for rental property. Select the applicable Activity Type. Income (loss) from activities coded as Rental real estate - Does not actively participate, Rental real estate - Active participation, and Other passive automatically carry to the passive activity loss computations on Form 8582.

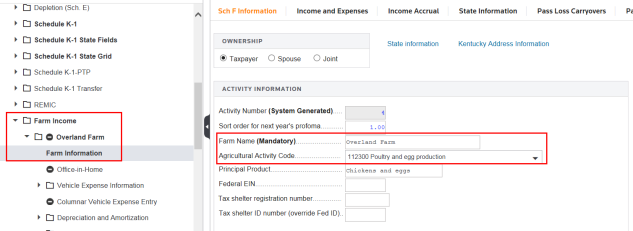

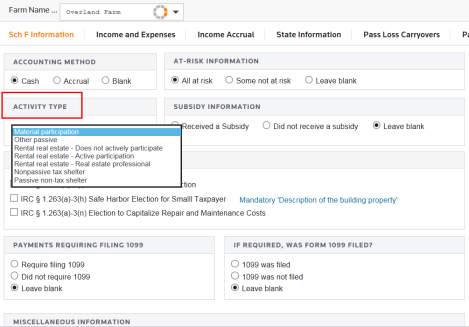

The Activity Information tab for farm activities is similar to that for rental property. Scroll down this screen to select the activity type and participation options for farm activities.

It is a good practice to review the Organizer screens for each activity to ensure that passive/nonpassive options are correctly selected. Notice that the farm options are different than the rental properties or the Schedule K-1s.

If the taxpayer receives a K-1 with multiple activities, the passive and non-passive income from these activities can be entered on the same K-1 if the deductions and AMT adjustments are either passive or non-passive. If there are both passive and non-passive deductions and AMT adjustments, then each activity should be entered separately to specify different tax treatments. It is possible to have more than one type of income from a single activity.

Portfolio income may be included in an activity that, as a whole, is treated as earned income, or passive income from rental real estate, or other passive income. The net income attributable to portfolio items carries to Schedule B. The investment interest expense attributable to portfolio income carries to Schedule A, line 13.

This taxpayer actively participates in the partnership’s rental real estate activity. Current year passive income or loss will flow to Form 8582, Worksheet 1.

Here is the RX-Rentals - Equipment with passive participation. Current year passive income or loss will flow to Form 8582, Worksheet 3.

Tutorials/1040_passive_data_entry.htm/TY2019

Last Modified: 08/26/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.