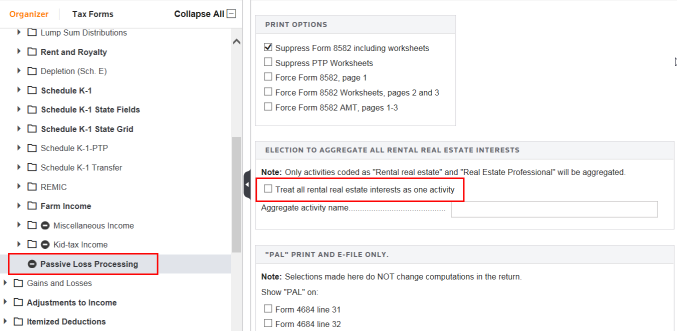

1040: Passive Losses - Aggregate Rental Real Estate Interests

Each interest in rental real estate is treated as a separate activity and participation must be determined separately, unless an election is made to treat all interests in rental real estate as one activity. This election can be made on the Income > Passive Loss Processing screen. The election makes it easier to meet the participation requirements. The election permits net income from the aggregate rental activity to offset prior-year disallowed losses, no matter which activity produced the income or the prior-year disallowed loss.

Tutorials/1040_passive_aggregate.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.