1040: Tax Review

Tax Review Workpapers provide a concise and complete audit trail of the federal 1040 tax return. They are available if the Tax Review product is purchased.

The Workpapers link current-year source data and the final tax return amounts by presenting all adjustments made to the source amounts.

Tax Review Workpapers contain a summary reconciliation of Form 1040, pages 1 and 2 amounts, and a detail list showing all items of input for the return and all corresponding adjustments made to those amounts.

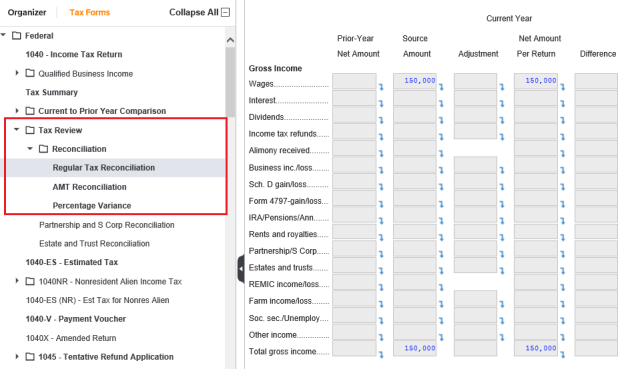

Access Tax Review Workpapers from the Tax Review folder under the Tax Forms tab. You can use Tax Review to pinpoint areas of concern and areas needing further investigation. Tax Review shows input/output, differences, and variances from prior-year amounts.

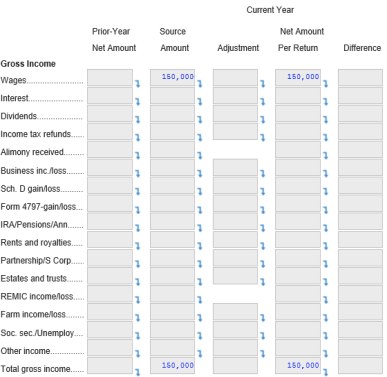

Notice each line of the tax return is listed. The prior-year net amounts are helpful in pointing out problems or omissions when compared against the current year amounts. The source amounts are the amounts you actually enter in the Organizer forms.

The net amount per return is the actual amount appearing on the lines of the tax return. The Difference column points out any overrides that do not match the detail data entered at the organizer level. There should never be amounts in the Difference column. It is a definite sign that the return has errors. The Adjustments column are automatic adjustments made by the tax application. This might be due to a limitation or the amount may just not be taxable, such as the interest or dividends shown here. You may have had tax-exempt interest or non-taxable dividends that were entered in the organizer but are not taxable in the return.

Tutorials/1040_tax_review.htm/TY2019

Last Modified: 10/07/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.