1040: Income and Deductions

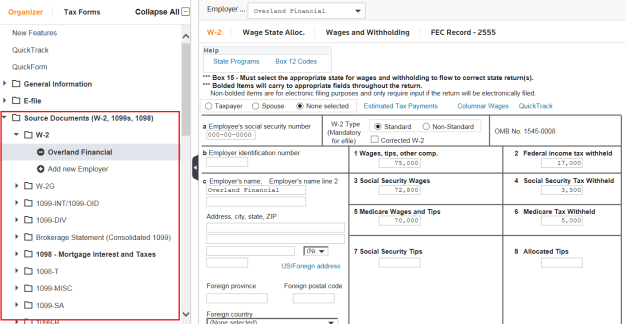

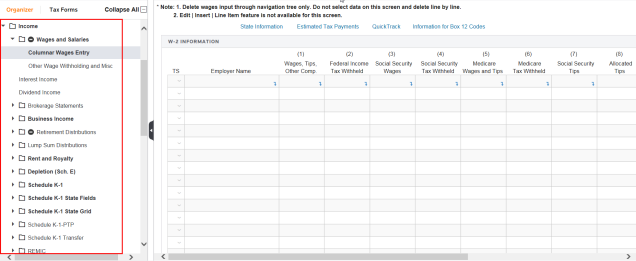

Each employer has its own folder in the Source Documents (W-2, 1099s, 1098) > W-2 folder. The employer’s information is proformaed from year to year so you will only need to enter the amounts from the W-2s. You can add new employers and delete existing or proformaed employers if they are no longer applicable.

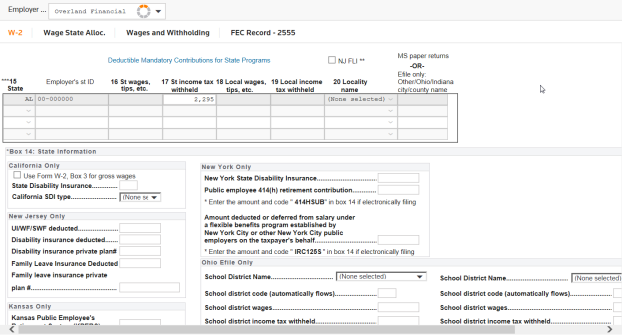

Enter state information for this employer on the bottom of the W-2 tab, or go to the Wage State Alloc screen.

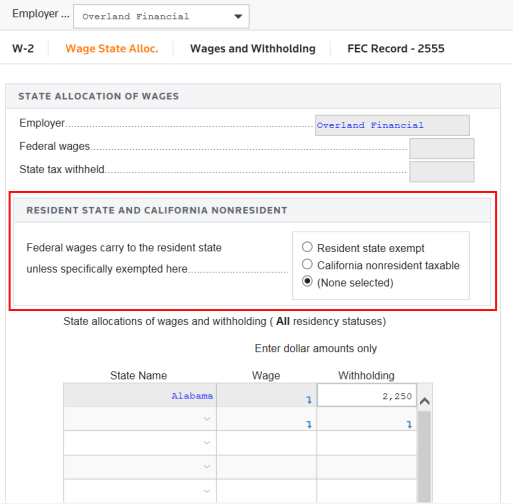

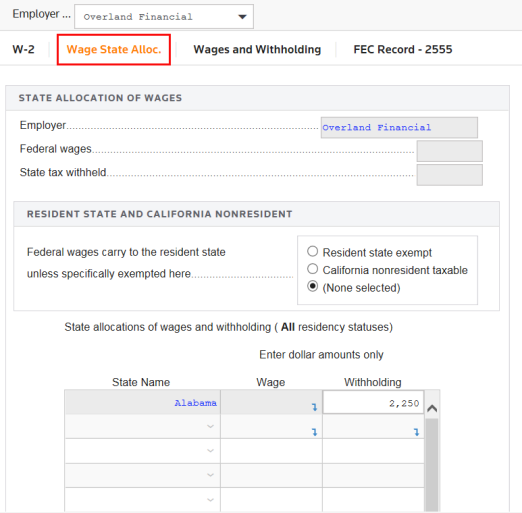

The federal information automatically flows to the resident state unless you allocate it to multiple states.

Select the state to which your wages/withholding should flow in the State Name column. Then enter the amount of wages and withholding to flow to that state. The withholding amount should be some portion or all of the amount you entered for state withholding on the Wages and Withholding federal screen. Any difference between the federal amount and the state allocated amount is automatically carried to the resident state.

You may NOT enter a taxable percentage on the Wage Income screen. You MUST enter a dollar amount.

The Income and Adjustment to Income folders contain a subfolder for each income and deduction item on the 1040 return. These folders are organized in the same order they are found on Form 1040.

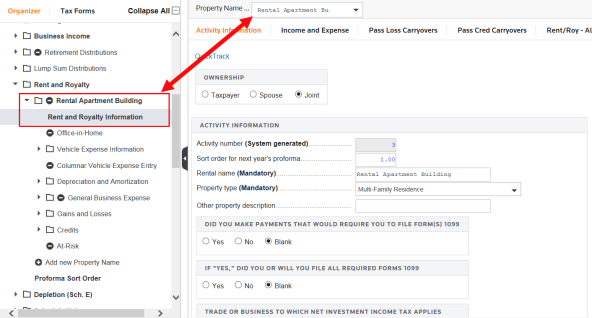

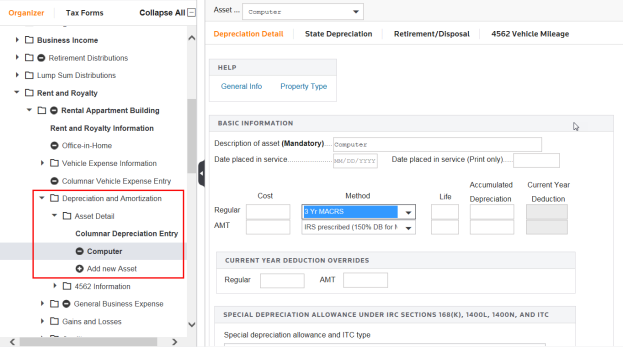

Each activity will have its own folder and separate set of subfolders, for example as shown below, the Rent and Royalty area. This enables you to keep all information for a particular activity together.

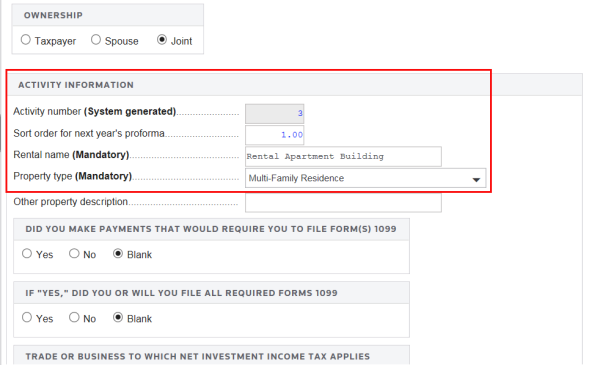

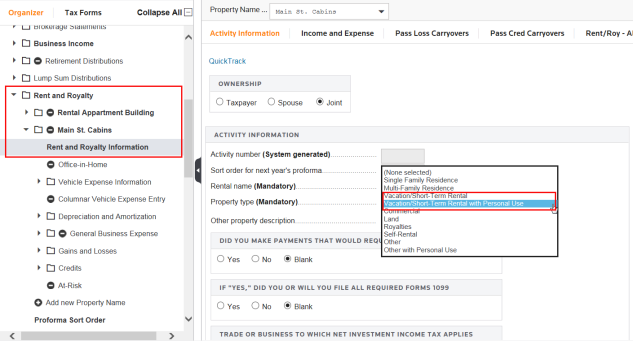

Each income activity is automatically assigned a unique activity number to identify it. The Kind of Property and Type of Property are also required entries. When adding a new activity, you will be prompted to enter this information. Also scroll down to select the Activity Type. The Rental Name and Property Type are required entries. When adding a new activity you will be prompted to enter the Property Name.

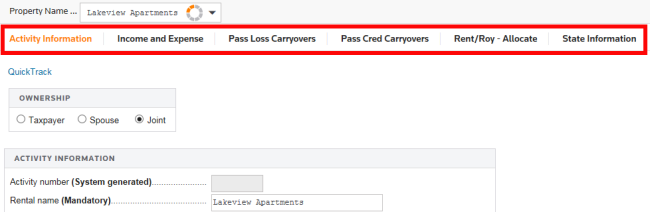

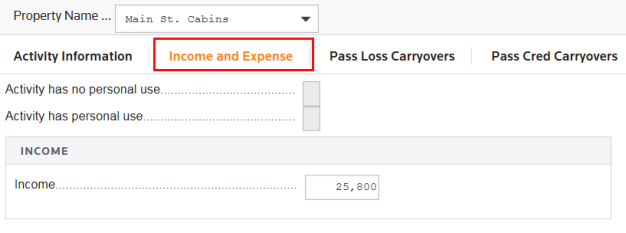

Click the applicable tabs to enter more information for this activity.

Each activity has a Depreciation and Amortization folder used to tie assets and related depreciation information to the selected activity.

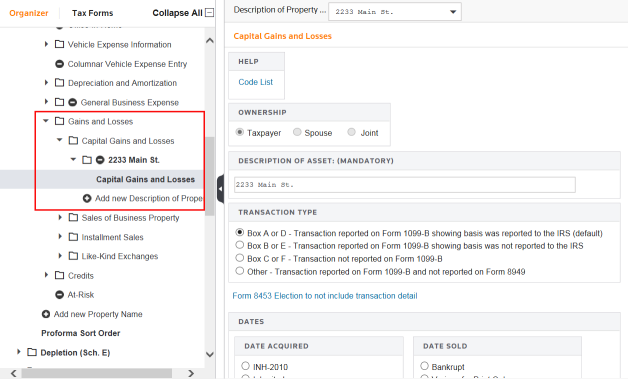

Gains and losses related to an activity should be entered in the Gains and Losses folder for that particular activity.

Use the Vacation/Short-Term Rental with Personal Use or Other with Personal Use Property types for rental properties with personal use.

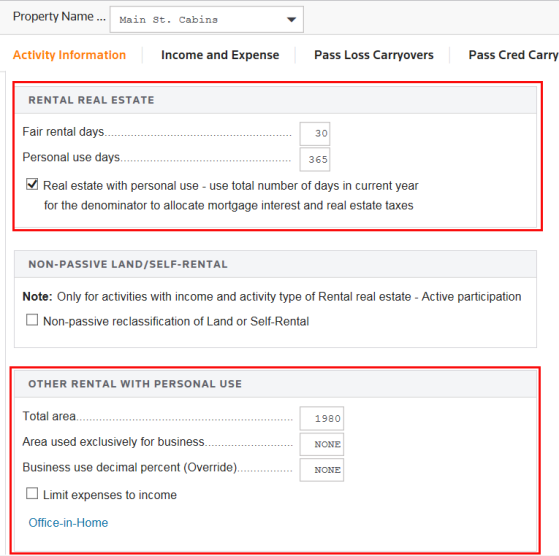

Scroll down to enter the remaining activity information. For Vacation/Short-Term Rental with Personal Use, enter the Fair Rental days and Personal use days. For Other with Personal Use, enter the square footage information or enter a Business use percentage override.

The system uses the income entered here for calculating the office-in-home limitation only. Indirect expenses are allocated between business and personal use; direct expenses are for business use only.

Tutorials/1040_income_deductions.htm/TY2019

Last Modified: 08/13/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.