1040: General Information

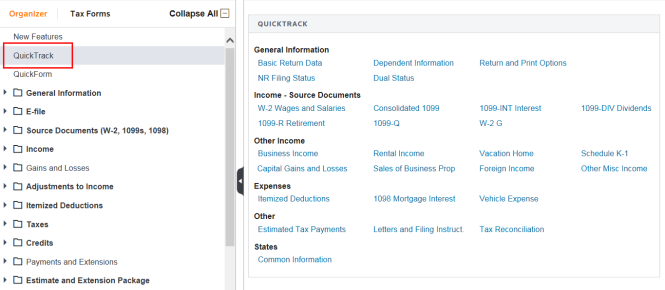

QuickTrack is a navigation tool that saves the tax preparer time and helps new users get to the most commonly used Organizer forms quickly. Just click one of the buttons to go directly to the Organizer form.

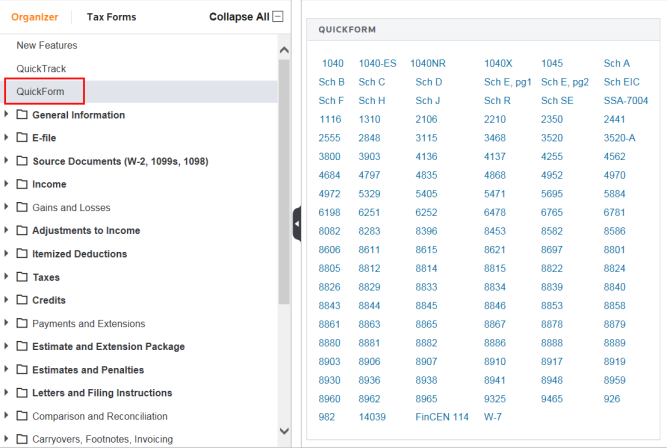

QuickForm is a navigation tool that saves the tax preparer time and helps new users get to the Organizers by form number. Just click one of the buttons to go directly to the Organizer for the selected form.

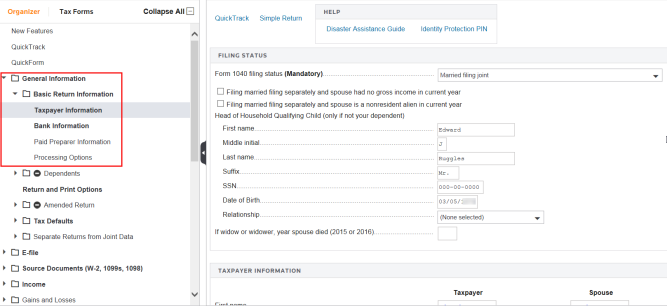

The traditional navigation appears in the Forms List Window. The General Information > Basic Return Information > Taxpayer Information folder provides fields to enter the basic return data and select your default return and print options.

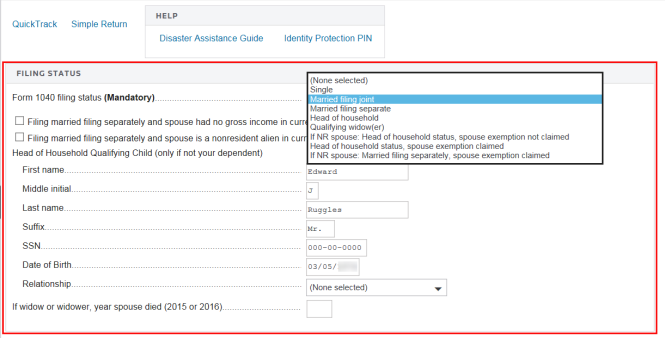

On the Basic Return Information screen, enter filing status information for the taxpayer. It is extremely important to select a filing status. If you do not, the return will not compute (even though it may appear to do so).

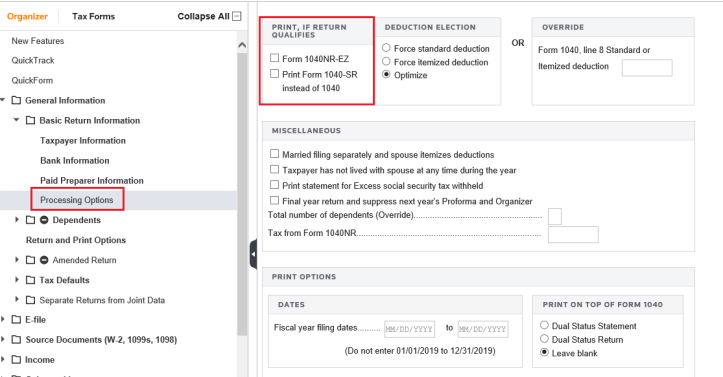

The default return type is 1040; you can also select 1040NR-EZ or 1040-SR. If you want to force the use of standard or itemized deductions, select the appropriate options on the General Information > Basic Return Information > Processing Options screen. The default is to use the optimal selection.

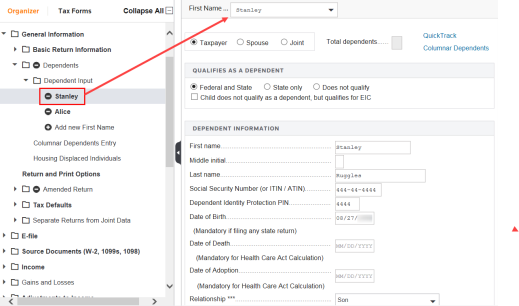

The dependents information will be proformaed from year to year. To add a new dependent, go to General Information > Dependents > Dependent Input, and select Add new First Name. You will then be prompted to enter the dependent’s name and enter information for that dependent.

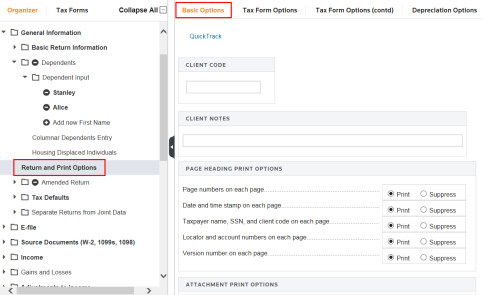

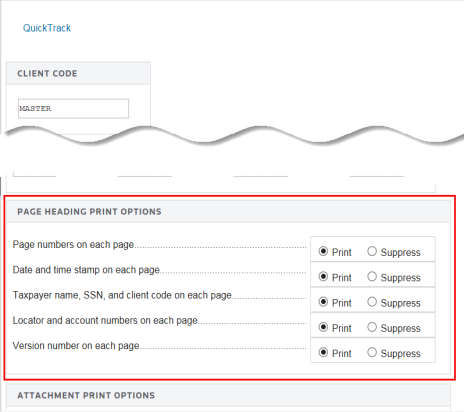

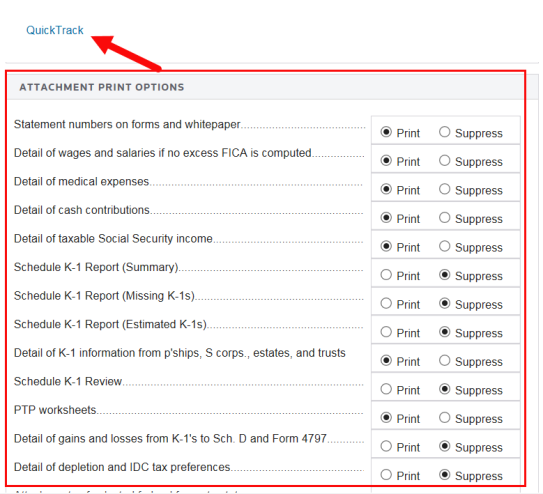

Use return and print options to control such factors as which forms/schedules will print, what optional information will print on forms and attached statements, and which detail statements will be generated.

These options are normally set up as Tax Defaults in RS Browser, but they may be entered (or changed) on a return-by-return basis on the General Information > Return Options > Basic Options screen.

Available selections on the Basic Options tab will affect the entire return. These options are not specific to a particular form or schedule. You can return to the QuickTrack navigation menu by clicking the Quick Track button.

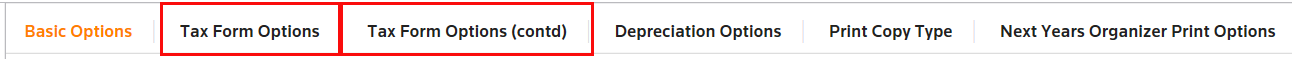

For form- or schedule-specific options, select the Tax Form Options or Tax Form Options (cont’d) tab. Selections on these screens pertain to the computation and/or print of specific forms.

Tutorials/1040_general_information.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.