1040: Expatriate Returns - Form 1116: Foreign Tax Credit

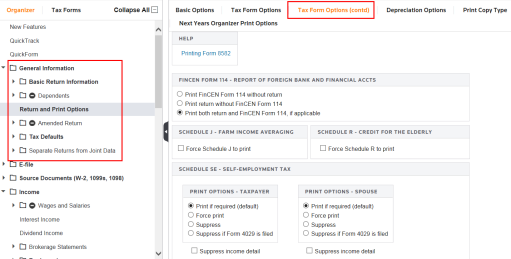

The Return and Print Options screen in the General Information folder contains options and data that apply to all Forms 1116 in a return. In the tax application, you can scroll down to view additional options and overrides.

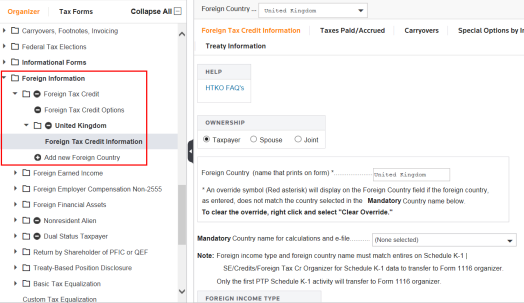

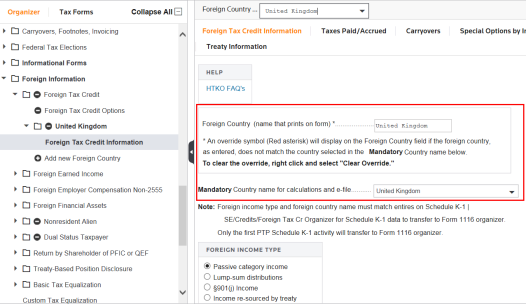

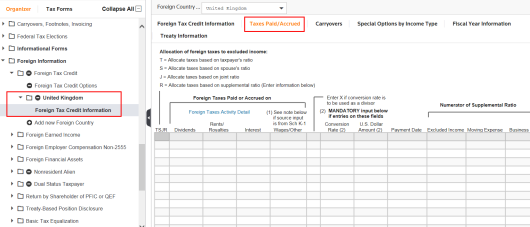

Entries are made in the Foreign Information > Foreign Tax Credit folder to generate Form 1116 - Foreign Tax Credit. Enter information for a specific income type and country on the Foreign Tax Credit Information screen related to that country. First, select an existing country from the drop-down list or, choose Add New Foreign Country.

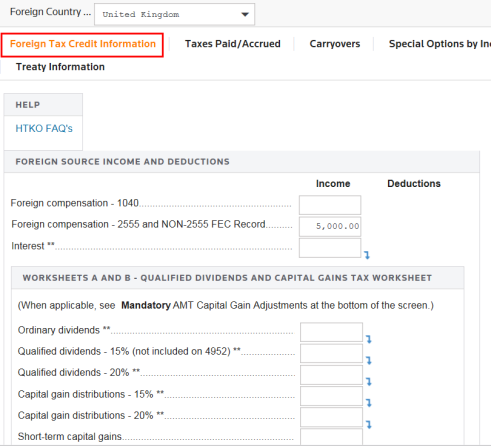

Enter general information and income and deductions on the Foreign Tax Credit Information screen. Use the tabs to access the additional data entry areas for this country. The country name is a mandatory entry for Form 1116; the country code is mandatory for e-filing.

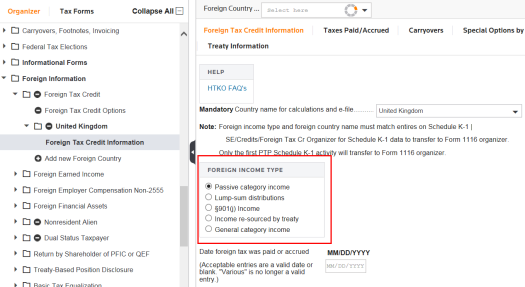

You can select from a list of income types to determine the appropriate tax treatment. In this example, Passive Income is selected.

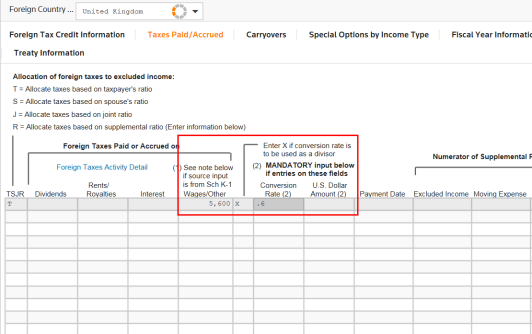

Click the Taxes Paid/Accrued tab to enter this information.

In this example, tax of 5,600 pounds (.6 British pounds to $1 US) was paid on Wages/Other income.

The first Foreign Tax Credit Information screen with general limitation income automatically brings foreign sourced income in from Form 2555 if no entry is made on the Foreign Compensation - 2555 field.

Tutorials/1040_expat_1116.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.