1040: AMT Depreciation

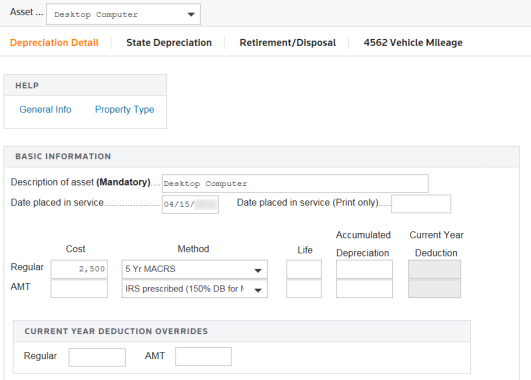

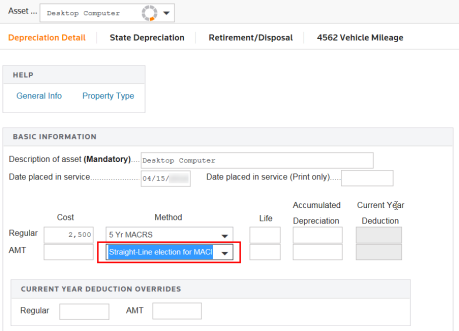

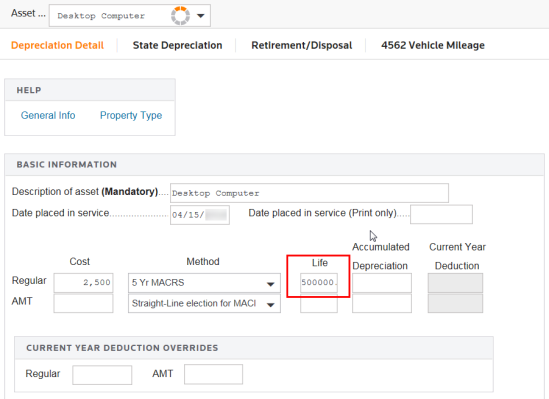

ADS depreciation computes using the 150% declining balance method (switching to straight line when the expense is greater). You can elect to compute AMT straight line depreciation on MACRS personal property. To compute AMT straight line depreciation on MACRS personal property instead of using the 150% declining balance method, you must select the Straight-Line election for MACRS property and enter an AMT life.

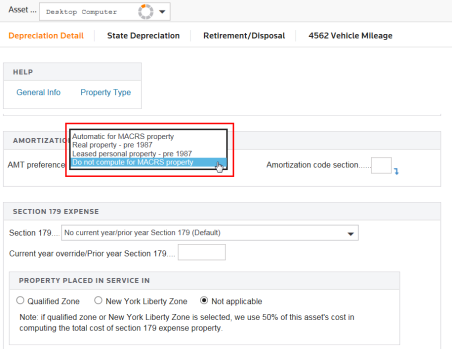

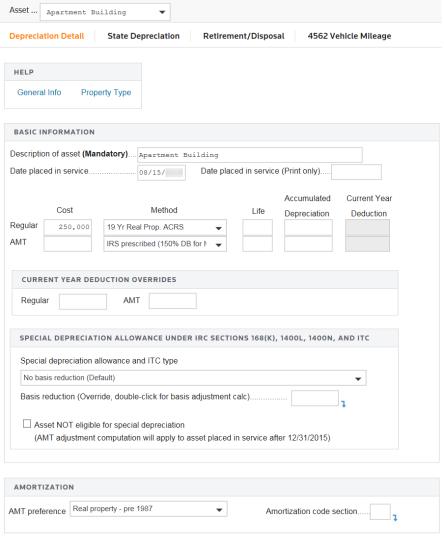

For MACRS real property, ADS depreciation always computes using the straight line method over a 40 year life. To suppress the AMT calculation of tax preference on MACRS real property, select Do not compute for MACRS.

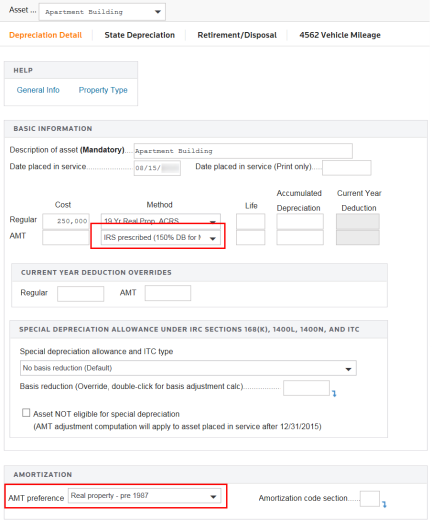

Still under the Depreciation Detail tab, scroll down to the Amortization section and select one of the AMT preference selections from the drop-down list.

If you elect straight line depreciation for MACRS personal property for regular tax purposes, tax preference depreciation computes using the straight line method over the same life as used for regular tax purposes.

The system makes no adjustments. You may override the life used in the AMT life field.

Entering a life in a MACRS method asset forces straight-line.

For ACRS property to have a preference calculation for AMT, you must make a tax preference selection (leased personal property or real property) in the Compute AMT for field on the Depreciation Detail tab. To access this option, scroll down the Depreciation Detail tab to the Amortization section.

If you choose, you can override the current year AMT deduction calculation on the Depreciation Detail tab. Make your tax preference selections in the Compute AMT for field in the Amortization section.

Tutorials/1040_amt_depr.htm/TY2019

Last Modified: 08/26/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.