1040: AMT Data Entry

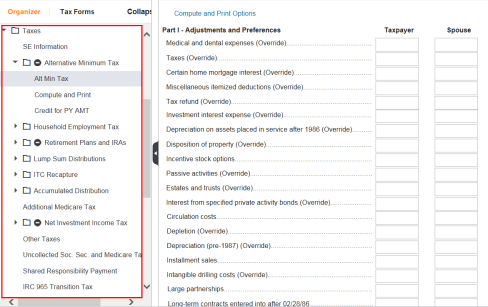

Form 6251 calculates the alternative minimum tax (AMT) liability and prints even if no entries are made on the Alt Min Tax screen of the Taxes > Alternative Minimum Tax folder.

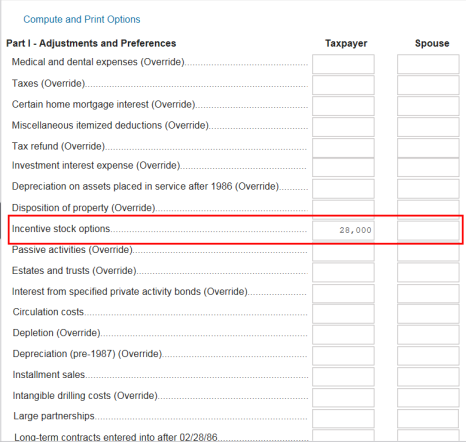

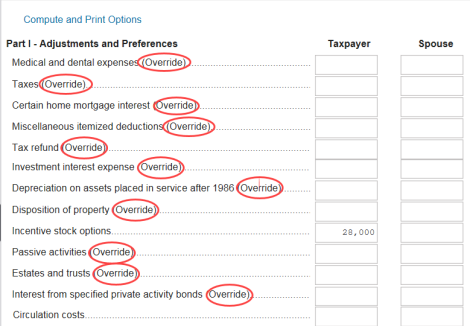

Use the Alt Min Tax screen to enter the transactions which are not automatically adjusted for AMT by the tax application. These transactions will not have (Override) after their descriptions such as Incentive Stock Options.

The following items are not automatic and will need to be entered here if applicable:

- Circulation, research, and experimental expenditures

- Mining exploration and development expenditures

- Long-term contracts entered into after 2/28/86

- Pollution control facilities

- Installment sales

- Incentive stock options

- Interest expense incurred on acquiring private activity bonds

- Disallowed portion of interest expense on private activity bonds

- AMT net operating loss carryover

- Charitable contributions of certain property

You can also use the Alt Min Tax screen to override the system-generated amounts.

Tutorials/1040_amt_data_entry.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.