1040: AMT Adjustments

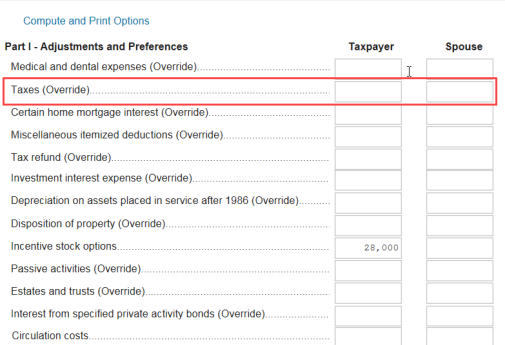

The Taxes adjustment is calculated from the total taxes on Schedule A, line 7. If you want an amount other than this for the taxes adjustment, make an overriding entry here.

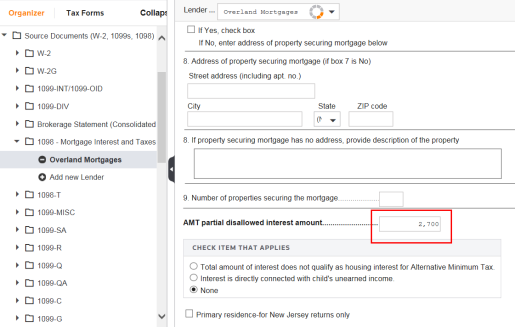

You can now disallow a portion of the AMT by entering an amount in the AMT partial disallowed interest amount field.

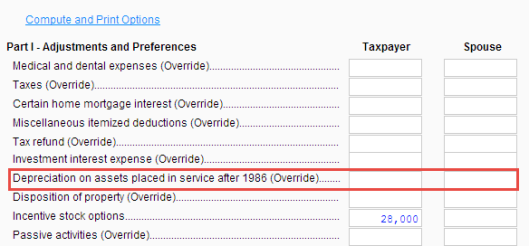

Depreciation recomputes for AMT purposes. The difference between the recomputed and the actual depreciation claimed in the return carries as an adjustment to taxable income for AMT. If the entity is reported on Form 8582, the depreciation adjustment is included in Form 6251 as a passive activity loss. It will not appear on the depreciation line.

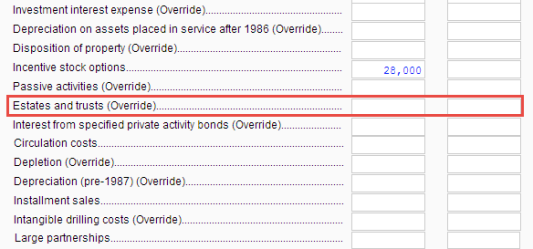

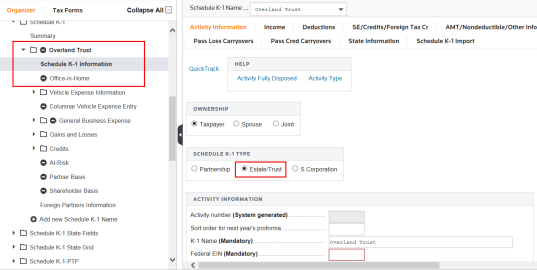

Amounts entered on the K-1 Information screen that are coded as Estate / Trust and any amount entered as an adjustment for minimum tax purposes will carry to Form 6251 automatically.

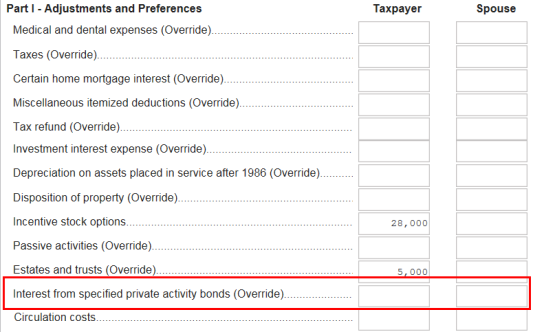

The sum of the private activity bonds entered on the Interest Input screen and Form 8814 is adjusted. Then the adjusted amount carries to Form 6251 as a preference item. This sum is then decreased by an entry on the Interest expense incurred on acquiring private activity bonds field and increased by an entry on the Disallowed portion of interest expense on private activity bonds field.

Tutorials/1040_amt_adjustments.htm/TY2019

Last Modified: 08/26/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.